Scotia Low Carbon Funds

A part of Scotia Global Asset Management’s growing suite of Environmental, Social and Governance (ESG) of solutions

Why invest?

Scotia Low Carbon Funds will appeal to investors who are seeking:

Competitive risk-adjusted returns while lowering the carbon intensity of the portfolio relative to the benchmark.

A fund that minimizes the cyclical highs and lows of dedicated energy exposure by excluding energy sector* and non-energy sector investments that are materially exposed to the fossil fuel supply chain.

An actively managed solution that considers ESG factors as part of a disciplined fundamental investment process.

To benefit from the transition to a low-carbon economy by focusing on higher-quality businesses that are less dependent on fossil fuels for their long-term success.

Scotia Low Carbon Funds overview

Scotia Low Carbon Funds are intended for environmentally-conscious investors seeking a diversified portfolio of high-quality investments with lower carbon intensity than the broader market.

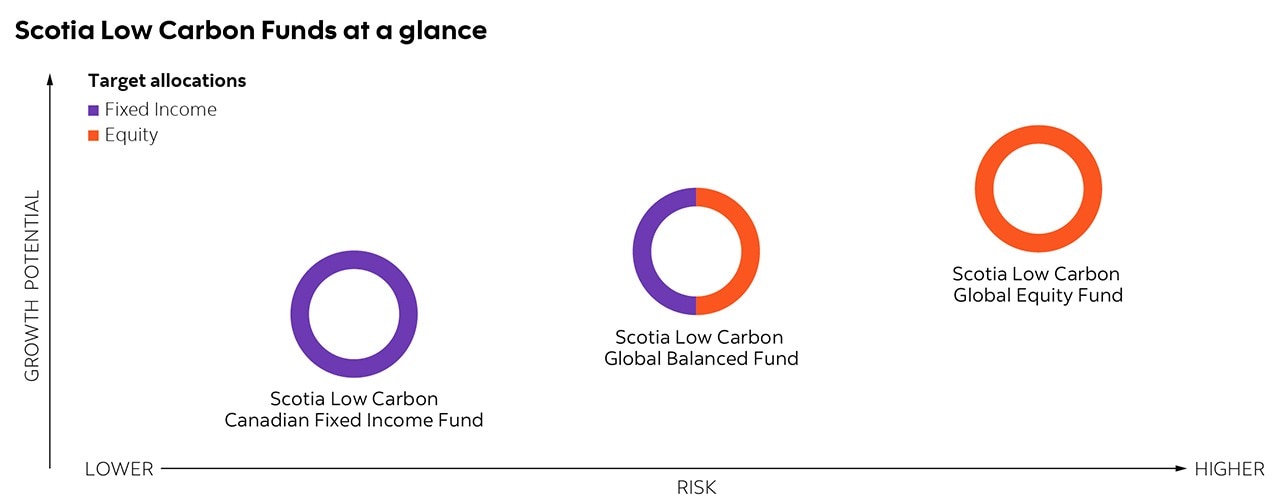

Scotia Low Carbon Canadian Fixed Income Fund

The fund’s objective is to provide regular income and modest capital gains, and is met with a portfolio of investments that, in aggregate, the portfolio advisor assesses to have a lower carbon intensity than that of the broad market. The Fund invests primarily in a diversified portfolio comprised of income producing Canadian securities, either directly and/or indirectly through other investment funds.

Scotia Low Carbon Global Balanced Fund

The fund’s objective is to generate income and long-term capital growth, and is met with a portfolio of investments that, in aggregate, the portfolio advisor assesses to have a lower carbon intensity than that of the broad market. The Fund invests primarily in a combination of global equities and Canadian fixed income securities, either directly and/or indirectly through other investment funds.

Scotia Low Carbon Global Equity Fund

The fund’s objective is to achieve long-term capital growth, and is met with a portfolio of investments that, in aggregate, the portfolio advisor assesses to have a lower carbon intensity than that of the broad market. The Fund invests primarily in a broad range of equity securities from around the world, either directly and/or indirectly through other investment funds.

Sub-advised by

Scotia Low Carbon Funds are sub-advised by Jarislowsky, Fraser Limited (JFL), a Canadian investment management firm whose history and culture are rooted in investment stewardship. This stewardship is expressed through an adherence to investing in higher-quality businesses, fundamental research, a long-term investment horizon, and the advancement of good governance and sustainable investing. JFL is a wholly-owned subsidiary of The Bank of Nova Scotia.

Additional resources

Scotia Low Carbon Funds Overview

N/A | pdf : 162

KB

Scotia Low

Carbon Canadian Fixed

Income Fund

Scotia Low

Carbon Canadian Fixed

Income Fund | pdf : 725

KB

Scotia Low

Carbon Global Balanced

Fund

Scotia Low Carbon Global Balanced Fund | pdf : 1

MB

Scotia Low Carbon Global Equity Fund

Scotia Low Carbon Global Equity Fund | pdf : 513

KB

Our ESG approach

As one of Canada’s largest asset managers, Scotia Global Asset Management Canada places the highest priority on the stewardship of our clients’ assets. We believe ESG considerations are a key component in delivering long-term value to clients.

Responsibility & Impact

We are guided by our purpose: for every future. A better tomorrow – where our clients, employees and communities all thrive – benefits everyone, including our Bank.

2025 Stewardship and Responsible Investment Report

We place the highest priority on the stewardship of our clients’ assets and we believe Environmental, Social, and Governance (ESG) considerations are a key component in delivering long-term value. Here’s what you need to know about how ESG factors are considered at Scotia Global Asset Management.