Corporate class

Tax smart solutions with Scotia Corporate Class Funds

Overview

Scotia Corporate Class Funds

Investing outside a registered plan often comes with an unwelcome tax bill. Scotia Corporate Class Funds offer tax advantaged income to help meet your ongoing income needs.

Tax-efficient income

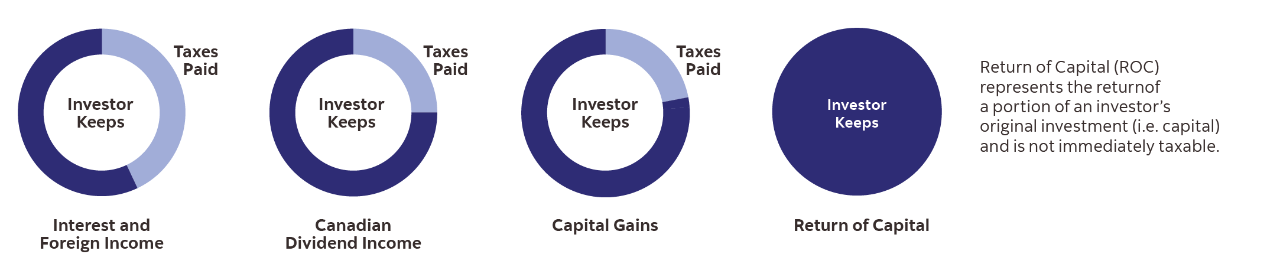

A mutual fund is required to pass on any net income it generates to investors. This income is subject to tax, which can take a bite out of your savings – especially if it’s in the form of higher-taxed interest and foreign income. When Scotia Corporate Class Funds distribute income to investors, they are structured to pass on capital gains dividends and ordinary Canadian dividends, two more tax-advantaged forms of income.. They also seek to reduce taxable distributions and minimize taxes by pooling expenses and capital losses with other Scotia Corporate Class Funds.

Corporate class income options

With Series T options, withdrawing an income from corporate class investments is easy. Series T corporate class mutual funds are designed to provide a regular, tax-efficient cash flow from your non-registered savings.

Benefits

- Receive regular cash flow while maintaining a professionally managed and diversified portfolio that’s suited to your individual needs.

- Greater tax efficiency by combining a variety of investment income sources, including Return of Capital (ROC).

- Stop, start or adjust your cash flow at your convenience by selecting the Series T portfolio that best suits your income needs.

Tax-advantaged income

Scotia Corporate Class Series T options use a combination of income sources, including ROC, that are designed to potentially create more tax-efficient cash flow than traditional income-producing investments alone. Return of capital represents the return of a portion of your original investment (i.e. capital) and is not immediately taxable.

Learn more about our tax smart corporate class funds and portfolios