Read about how tactical asset allocation helps keep portfolios on course with small, data-driven adjustments that respond to changing markets.

Scotia Essentials Portfolios™

*Or other investment products held in an eligible registered account. Bonus up to $3,750. Min transfer required. Conditions apply.

Learn more

What is a Scotia Essentials Portfolio?

It’s an all-in-one investment solution for your most important goals. You don’t need to be an expert, and you don’t need to manage it yourself.

We build and manage your portfolio, combining mutual funds and cost-effective ETFs.

You choose your goal and your comfort with risk.

Low fees, no hidden costs.

What makes Scotia Essential Portfolios different from other investments?

Whether you’re new to investing, new to Canada, or just want to find a simple way to invest, Scotia Essentials Portfolios are designed for you.

Saves you time

You don’t pick individual investments. Our team of professionals does—using the global resources of Scotia Global Asset Management.

Spreads your risk

Each portfolio includes a mix of asset classes, global markets, and investment styles which helps protect your money and grow it over time.

Adapts over time

Markets move and so should your portfolio. We actively monitor and adjust it to capture new investment opportunities.

Insert heading text

with an optional subtitleInvest with ease

Start with as little as $5001

Save automatically with pre-authorized contributions for as little as $25 per month

Options available for predictable monthly income.

Choose the right mix for you

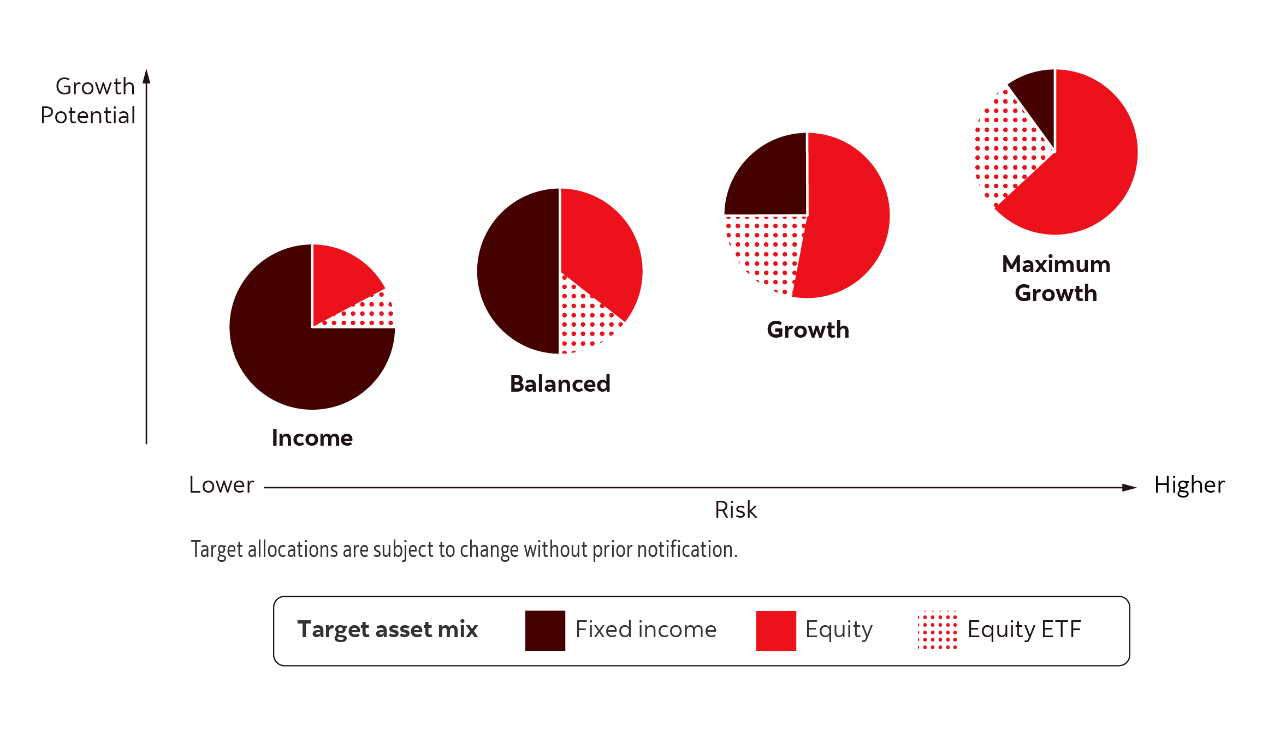

Choose from four Essentials Portfolios. Whether you're deciding on building a retirement portfolio, focused on growing your savings or prefer a conservative approach, each portfolio is constructed with a target asset mix to balanced risk and reward and keep financial goals on track.

To find your match, connect with a Scotiabank Advisor or get started with Scotia Smart Investor via Advice+.

Scotia Essentials Portfolios

Everything you need in one portfolio | pdf : 260

KB

How to get started

Create your plan to put your money to work towards your personal financial goals.

Step 1:

Tell us what you’re investing for

Whether it’s a home, retirement, or a big trip, we’ll work with you to choose the right mix.

Step 2:

Answer a few quick questions

We’ll help you understand your comfort with risk and your time horizon.

Step 3:

Get matched with a portfolio

We recommend the best-fit option from our four professionally managed portfolios.

Step 4:

Open your account online

And watch your money grow.

Additional resources

Discover the top investing lessons from 2025 and how they can help you navigate opportunities and uncertainty in 2026 and beyond.

Monthly highlights of major events which drive financial markets, along with perspectives on what they mean and why they matter.

About Scotia Global Asset Management

At Scotia Global Asset Management®, we're proud of our history and the trust we've built to become one of Canada's largest asset managers, responsible for more than $350 billion in investments on behalf of our clients2.

* The Scotiabank Investment Tiered Offer (the “Offer”) is available between November 1, 2025 and March 2, 2026 (the “Offer Period”) to individuals who open one or more new Eligible Registered Account(s) (defined below) with either The Bank of Nova Scotia or Scotia Securities Inc. and complete certain qualifying transactions.

For the purposes of this Offer, the following “Eligible Registered Accounts” are eligible for the Offer: Scotia Registered Retirement Savings Plans (excluding Locked-in plans such as LIRAs and LRSPs) (each an “Eligible RRSP”), Tax-Free Savings Accounts (each an “Eligible TFSA”), and First Home Savings Accounts (each an “Eligible FHSA”). Scotia RRIFs, RESPs, RDSPs, and non-registered Scotia Investment Accounts are not eligible for the Offer. In order to qualify for a Cash Bonus (defined below), the individual cannot currently or in the 6 months preceding the Offer Period have held the same Eligible Registered Account type with either The Bank of Nova Scotia or Scotia Securities Inc. (together, “Scotiabank”) as the Eligible Registered Account they opened during the Offer Period.

To qualify for a cash bonus (the “Cash Bonus”):

1. Open one or more new Eligible Registered Account(s) during the Offer Period.

2. By March 2, 2026, contribute a Qualifying Investment Amount (as set out in the table below) into one or more of your new Eligible Registered Account(s) and maintain that Qualifying Investment Amount for a minimum of three (3) consecutive months to qualify for the following applicable Cash Bonuses:

Cash Bonus (in CAD) |

Qualifying Investment Amount (in CAD) |

$150 |

$10,000 - $19,999 |

$300 |

$20,000 - $49,999 |

$750 |

$50,000 - $99,999 |

$1,500 |

$100,000 - $249,999 |

$3,750 |

$250,000 and above |

3. By March 2, 2026, set up and clear one recurring pre-authorized contribution (PAC) from any personal bank account with a minimum total monthly value of at least $100 into any of your new Eligible Registered Accounts. The PAC must recur for a minimum total of three (3) consecutive months and at least one recurring PAC must be received during the Offer Period to qualify.

Calculation of Cash Bonus:

The qualifying Cash Bonus will be determined by the Qualifying Investment Amount, which is calculated based on the book value of all contributions made to the client’s Eligible Registered Account(s) combined during the Offer Period. For clients making contributions in non-Canadian dollar currencies, the Qualifying Investment Amount will be calculated based on the Canadian dollar equivalent at the Scotiabank foreign currency exchange rate in effect on the contribution date.

For example, a client who deposits CAD$5,000 into a new FHSA and CAD$15,000 into a new TFSA during the Offer Period, will qualify for a Cash Bonus of CAD$300 based on the combined contribution amount of CAD $20,000.

The Cash Bonus will be paid in Canadian dollars.

General Terms:

Clients are responsible to confirm their contribution limits prior to making any contribution to their Eligible Registered Account(s). Scotiabank is not responsible for any contributions over a client's limit in connection with this Offer. The Cash Bonus is not considered a contribution and therefore will not impact contribution limits. Clients should consult with a tax advisor to discuss any tax implications in connection with this Offer and clients are responsible for any required tax reporting.

Provided all Offer conditions have been met, the Cash Bonus will be paid to your Eligible Registered Account(s) within approximately three (3) months from May 31, 2026. For the Cash Bonus to be paid, the client’s new Eligible Registered Account(s) must be open and in good standing until the time of payout of the Cash Bonus. For purposes of this Offer, an Eligible Registered Account is not in 'good standing' if the account holder is in breach of the Eligible Registered Account’s client account agreement.

If multiple Eligible Registered Accounts are opened, the Cash Bonus will be paid into the Eligible Registered Accounts on a pro rata basis as a percentage of the total Qualifying Investment Amount. For example, if you invest $15,000 into an Eligible TFSA and $10,000 into an Eligible FHSA, you will qualify for a Cash Bonus of CAD$300, which will be paid as follows: CAD$180 (60%) in the Eligible TFSA and CAD$120 (40%) in the Eligible FHSA.

If multiple Eligible Registered Accounts of the same type are opened, the Cash Bonus (or the pro rata portion of the Cash Bonus, if applicable) will be paid to the first Eligible Registered Account of the same type that is opened during the Offer Period. For a spousal RRSP, the Cash Bonus will be paid into that plan and not paid to the contributor.

This Offer is non-transferable, non-saleable, may not be exchanged for cash and may not be duplicated. Limit of one (1) Cash Bonus per client, regardless of the number of Eligible Registered Accounts opened. Offer may be changed, cancelled or extended at any time and cannot be combined with any other offers except as otherwise specified.