Retirement today is about sustainable income, not a magic number. Greg Sweet talks with Daryl Diamond about today’s retirement realities.

Scotia INNOVA Portfolios®

What is a Scotia INNOVA Portfolio?

It’s an innovative alternative to the traditional balanced investment portfolio. You can boost return potential and maximize diversification to better reach your most important financial goals, without the need do it alone.

We build and manage your portfolio by combining traditional assets with complementary alternative investments.

You choose your goal and your comfort with risk.

A single investment solution that removes the complexity, red tape and steep investment minimums that typically come with alternative investments.

What makes Scotia INNOVA Portfolios different from other investments?

Whether you’re new to investing or looking for a convenient way to invest in alternative assets and strategies, Scotia INNOVA Portfolios are designed for you.

Saves you time

We've got you covered—a fully diversified, all-in-one portfolio that leverages the extensive resources of Scotia Global Asset Management.

Enhanced growth potential and risk management

With a broader universe of investment opportunities available, each portfolio is thoughtfully diversified across traditional and alternative asset classes, global markets and investment styles to help protect your money and grow it over time.

Adapts over time

Markets move and so should your portfolio. We actively monitor and adjust it to rebalance, manage volatility and capture new investment opportunities.

Invest with ease

Start with as little as $5001.

Save automatically with pre-authorized contributions for as little as $25 per month.

Predictable monthly income and corporate class options available.

Choose the right mix for you

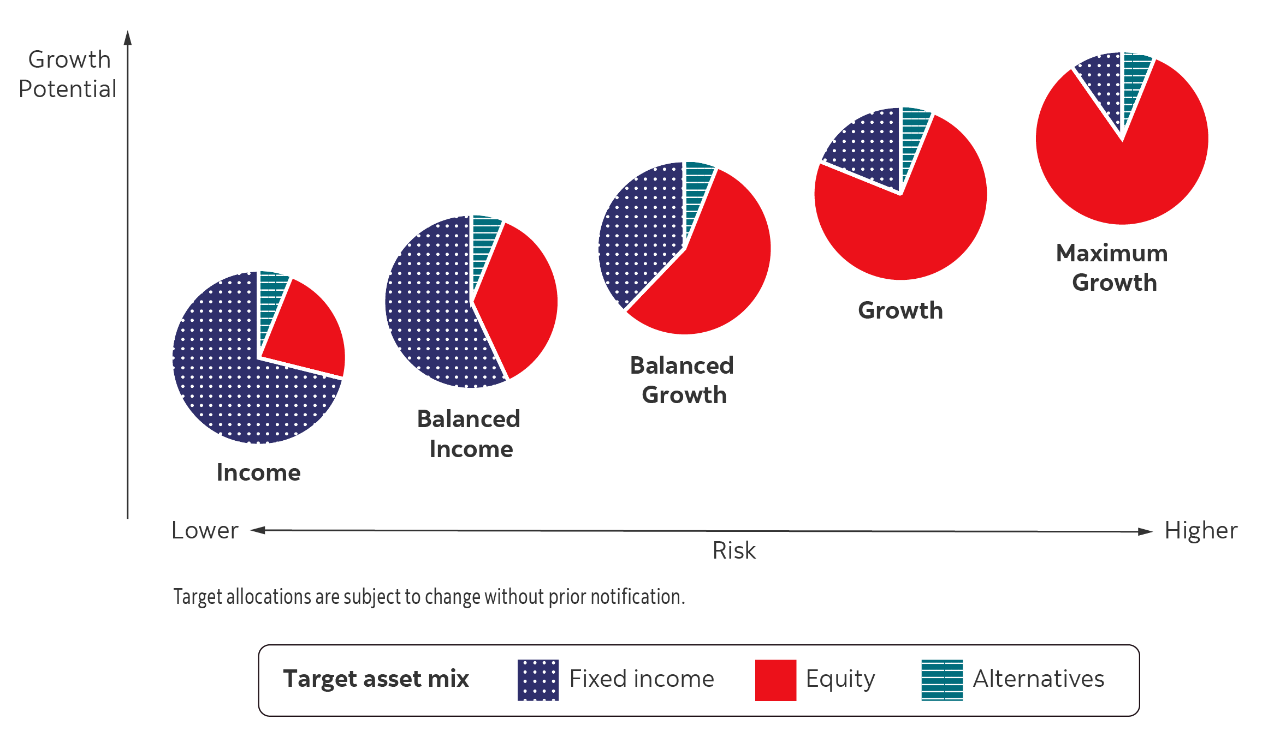

Choose from five professionally managed Scotia INNOVA Portfolios. To better help you achieve your goals, each portfolio is constructed with a target asset mix that includes complementary alternative assets to help manage risk and boost return potential.

To find your match, connect with a Scotiabank Advisor or get started with Scotia Smart Investor via Advice+.

Scotia INNOVA Portfolios

Innovation by design | pdf : 291

KB

How to get started

Create your plan to put your money to work towards your personal financial goals.

Step 1:

Tell us what you’re investing for

Whether it’s a home, retirement, or a big trip, we’ll work with you to choose the right mix.

Step 2:

Answer a few quick questions

We’ll help you understand your comfort with risk and your time horizon.

Step 3:

Get matched with a portfolio

We recommend the best-fit option from our four professionally managed portfolios.

Step 4:

Open your account online

And watch your money grow.

Contact us

Create your plan to put your money to work towards your personal financial goals.

Scotia Smart Investor

Are you a Scotiabank customer with access to online banking?

Online appointment booking

A quick, easy, and secure way to connect with a Scotiabank advisor matched to your needs.

Have a question?

We’re ready to give you advice.

Additional resources

Monthly highlights of major events which drive financial markets, along with perspectives on what they mean and why they matter.

About Scotia Global Asset Management

At Scotia Global Asset Management®, we're proud of our history and the trust we've built to become one of Canada's largest asset managers, responsible for more than $350 billion in investments on behalf of our clients2.