Charlie Munger was a renowned American businessman and investor, best known for his role as the vice chairman of Berkshire Hathaway, where he worked closely with Warren Buffett. Munger's contributions to the investment world include his emphasis on continuous learning, and his sharp analytical mind, which significantly influenced modern investment strategies.

Income:

- Salary/Wages: Earnings from your job.

- Freelance Work: Payments for freelance or contract work.

- Interest: Earnings from savings accounts or investments.

- Dividends: Payments from stocks or mutual funds.

- Rental Income: Money received from renting out property.

Expenses:

- Rent/Mortgage: Payments for housing.

- Utilities: Bills for electricity, water, gas, phone and internet.

- Groceries: Money spent on food and household supplies.

- Transportation: Costs for public transit, fuel, or car maintenance.

- Insurance: Payments for health, auto, or home insurance.

- Entertainment: Dining out, activities, etc.

- Subscriptions: Streaming services, fitness and wellness, food and meal kits, etc.

Pro tip: Review your bank statements to pinpoint exact dollar amounts and uncover other income and expenses.

The median is the middle value in a list of numbers. In a list of numbers sorted from smallest to largest, the median is the number that is exactly in the middle.

The 50/30/20 rule is a simple budgeting guideline which suggests allocating your income like so:

50% to needs (essentials like housing, groceries, and utilities)

30% to wants (non-essentials like dining out, entertainment, and hobbies)

20% to savings and debt repayment

8 minute read

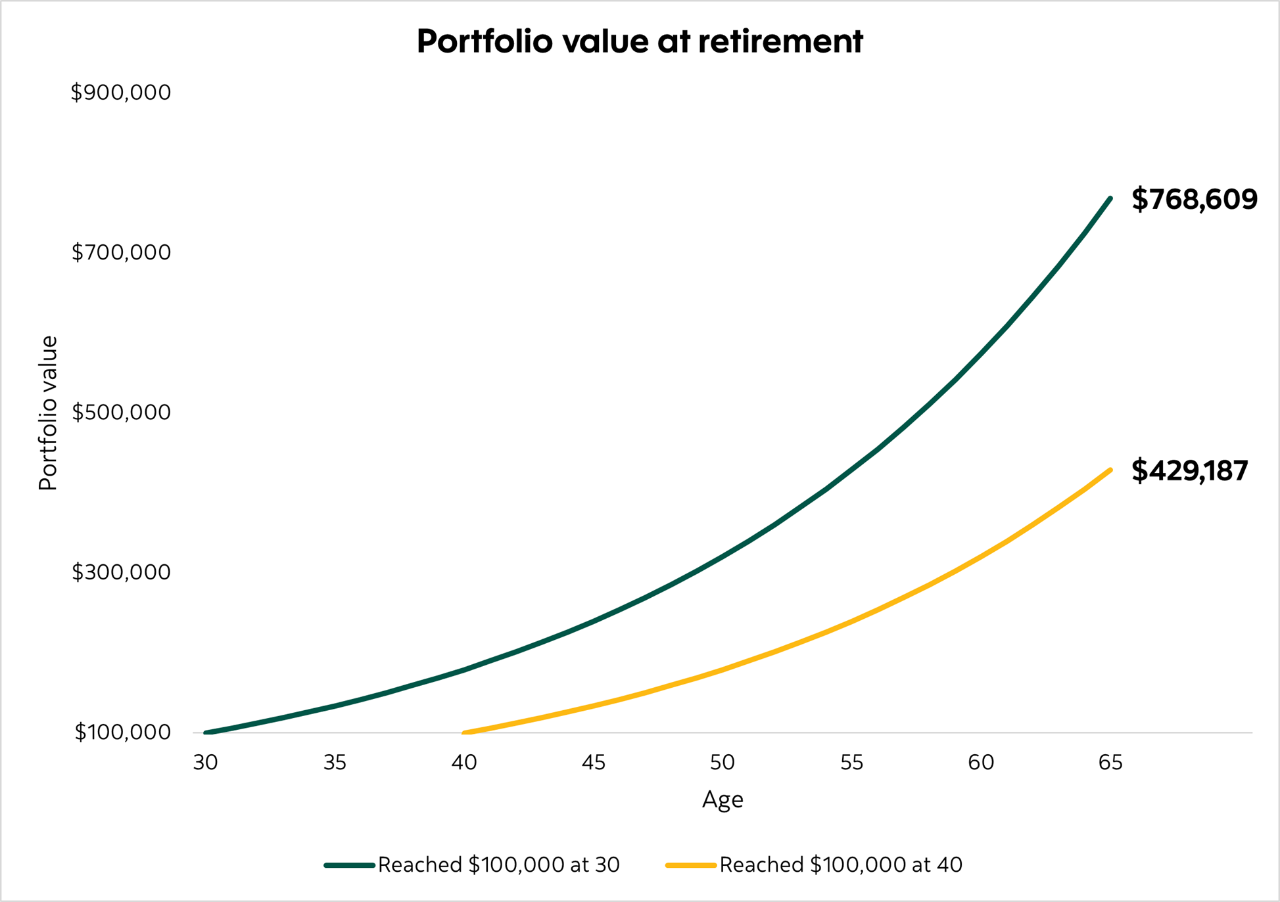

'You gotta do it': the late Charlie Munger once said reaching your first $100k in investments is the toughest, but the most crucial for building wealth and growing your net worth. This 6-figure target also helps break down monumental goals like retirement into more manageable milestones, making them feel more achievable. If you are starting your investment journey, try this simple but effective 3-step ACT process below to hit your first $100K.

- Assess your financial situation

- Choose an investment that aligns with your goals

- Track your progress regularly

Assess your financial situation

Calculate how much you can invest regularly.

Step one, review your income and expenses to know how much money is left over at the end of every month. You can do this the good old-fashioned way with a pencil and paper or try Scotia Smart Money or our online Money Finder Calculator. From there, determine the amount you’re comfortable with putting aside each month towards your financial goals.

Automate your savings.

1 in 2 Canadians prefer investing via pre-authorized contributions, PAC for short, because it simplifies and automates savings†. A PAC automatically transfers a set amount from your bank account to your investment account, with the dollar amount and frequency (weekly, bi-weekly, monthly, etc.) entirely up to you. You can set up a PAC online or with the help of your Scotia financial advisor.

† Source: Scotia Global Asset Management Investor Sentiment Survey, Fall 2024.

"Am I saving enough?"

This is a common question, and the answer varies for everyone. Here are some things you can consider:

Apply the 50/30/20 “rule”

Consider the 50/30/20 “rule” (Figure 1).

It isn’t a strict rule that’s set in stone – the percentage allocations are flexible – but the key is to maintain a balanced budget.

Figure 1: 50/30/20 budget rule

Average savings in Canada

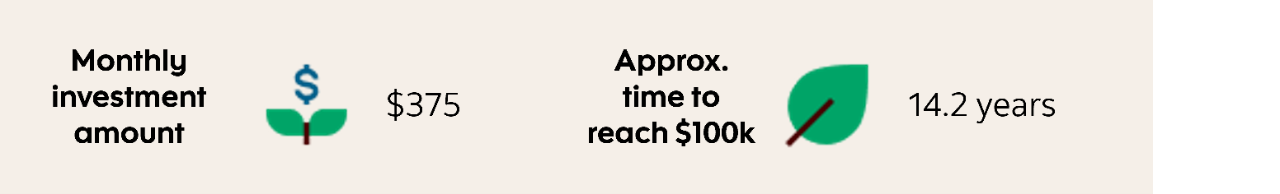

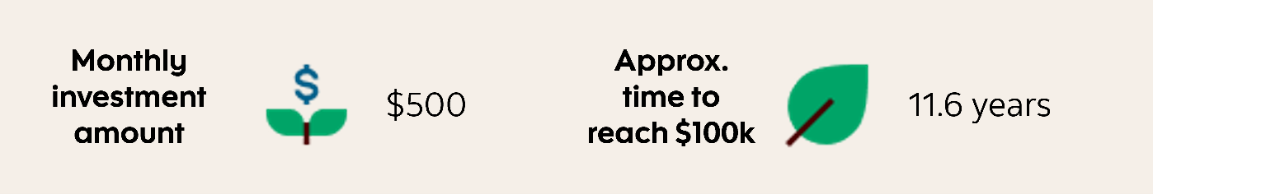

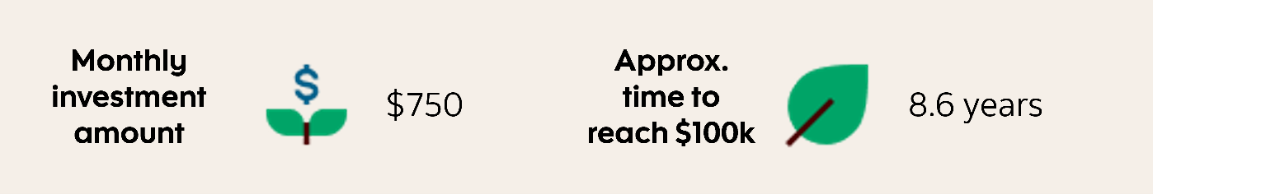

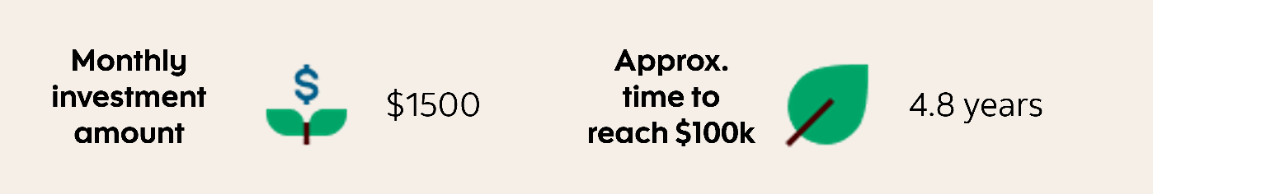

We asked Canadians how much they invest in a recent poll. 45% of Canadians said that they invest regularly each month. The median amount invested monthly was $375, with that amount increasing with age (Figure 2). While everyone’ situation is different, these figures can help provide a benchmark for your savings level.

Figure 2: Median monthly investment amount by age group in Canada

Source: Scotiabank 2024 Investment Poll.

Money finder tips

If the math isn’t mathing, here are some ways to find extra money to save:

- Have an honest conversation with yourself: what are your needs vs. “nice-to-haves?”

- Negotiate bills when possible

- Start a side hustle

- Find creative ways to save on things you enjoy (for example, dining at more affordable restaurants or watching movies on discounted days)

- Search for deals or wait for sales when making purchases

- Sell unused items

- Cut unnecessary subscriptions

Start today

The journey to $100k begins with a single step. Your financial future depends on the decisions you make today, so don't wait for the perfect moment—create it! Your future self will thank you for ACTing today and staying the course.

*As of December 31, 2024

$32,490 maximum contribution limit for 2025. $31,560 maximum contribution limit for 2024. $30,780 maximum contribution limit for 2023. $29,210 maximum contribution limit for 2022. $27,830 maximum contribution limit for 2021.

$27,230 maximum contribution limit for 2020. $26,500 maximum contribution limit for 2019. $26,230 maximum contribution limit for 2018.

Account must be opened in the previous calendar year for carry-forward room to apply.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently and past performance may not be repeated.

This document has been prepared by Scotia Global Asset Management and is provided for information purposes only.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Nothing in this document is or should be relied upon as a promise or representation as to the future. Indices are not managed and it is not possible to invest directly in an index.

ScotiaFunds® and Dynamic Funds® are managed by Scotia Global Asset Management, a limited partnership the general partner of which is wholly owned by The Bank of Nova Scotia. ScotiaFunds and Dynamic Funds are available through Scotia Securities Inc. and from other dealers and advisors. Scotia Securities Inc. is wholly owned by The Bank of Nova Scotia and is a member of the Canadian Investment Regulatory Organization.

Scotiabank® includes The Bank of Nova Scotia and its subsidiaries and affiliates, including Scotia Global Asset Management and Scotia Securities Inc. Scotia Global Asset Management® is a business name used by 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank.