Planning the income you’ll need in retirement is about more than just making sure you have enough money—it's also about understanding your lifestyle goals and the kind of retirement you want to experience.

Key messages:

- Planning the income you’ll need in retirement should be driven by your goals and needs.

- By understanding when and where your retirement income will come from, you can plan better to help you keep more of your money.

- Planning for retirement—and managing your finances once retired—is an ongoing process that changes as your goals and needs evolve.

You’ve done it—you’ve worked hard, saved regularly, invested wisely and now you’re ready to enjoy the rewards. Going from work to retirement is a big transition, and while your priorities may shift, the need for a plan remains.

Retirement income is much more than withdrawing funds when you need it—it’s also knowing your goals in retirement, identifying different sources of income available, figuring out tax efficient cash flow, maintaining the right investments and more.

To help you prepare for this next stage in life, this article highlights key considerations when planning your retirement income.

Consideration #1: Define your retirement goals and needs

A good place to start is by estimating your regular living expenses and lifestyle expenses you’ll need in retirement, and any legacy you would like to leave behind. A good estimate of these items will help you determine how much income you will need in retirement and provide the context needed to build your plan.

Consideration #2: Know your income sources

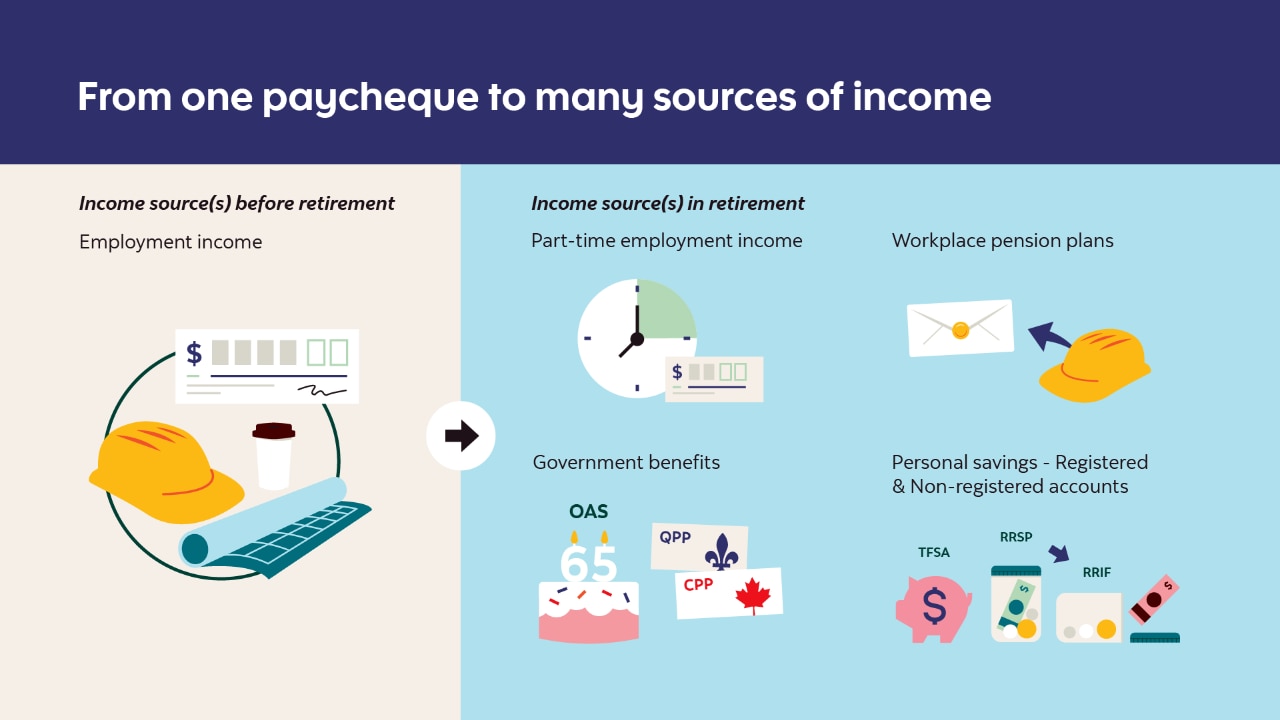

While you work, it’s likely your main source of income is your paycheque. In retirement, your income can come from a variety of different sources. Knowing your income sources and understanding the details of each can help you plan effectively. Creating a smart sequence for withdrawing retirement funds can make your savings last longer, improve tax efficiency, and meet your income needs. Some common sources of retirement income include:

Consideration #3: Manage investments and risk

Just like when you were saving for retirement, your investment approach in retirement should reflect your goal—such as covering income needs and keeping pace with inflation—along with your time horizon and comfort with risk. The key is finding the right mix of growth, stability, income, and flexibility that works for you. Because retirement goals vary, there’s rarely a one-size-fits-all solution.

Diversified investment options like Scotia Portfolio Solutions can help investors meet changing income needs and evolving goals as they transition to and live through retirement.

Consideration #4: Decide when and how to withdraw

Thoughtful cash flow planning can help you draw income from the right source at the right time to support retirement goals and needs—fund your retirement in a tax-efficient manner and keep more of your money working for you.

Does it make sense to collect pension benefits sooner or later? Is there an opportunity to split income with your spouse? What are the tax implications of selling your investments? Should you deplete your RRSP before your TFSA? Will withdrawing from your investments impact your income-tested government benefits? A Scotiabank advisor can help you address these considerations and more by recommending appropriate strategies that reflect your personal circumstances and preferences.

Consideration #5: Keep your plan up to date

Just as they did while you were saving for retirement, things can and will change in retirement, from evolving goals, shifting economic and market conditions, and changes to your personal circumstances. Keeping your plan up to date is something you don’t have to tackle alone—we are here to help. An advisor can help position your portfolio to meet changing retirement income needs over time and adjust your plans regularly to ensure your goals are met.

A Scotiabank advisor can help you define your retirement goals and needs, figure out the different income sources you may have and recommend strategies that make sense for you. Book an appointment today.

This publication is provided for information purposes only. It is not to be relied upon as financial, tax or investment advice or guarantees about the future, nor should it be considered a recommendation to buy or sell. Information contained in this document, including information relating to interest rates, market conditions, tax rules, and other investment factors, are subject to change without notice, and The Bank of Nova Scotia is not responsible to update this information. All third-party sources are believed to be accurate and reliable as of the date of publication, and The Bank of Nova Scotia does not guarantee its accuracy or reliability. Readers should consult their own professional advisor for specific financial, investment and/or tax advice tailored to their needs to ensure that individual circumstances are considered properly, and action is taken based on the latest available information. This publication may contain forward-looking statements based on current expectations and projections about future general economic factors. Forward-looking statements are subject to inherent risks and uncertainties which may be unforeseeable and such expectations and projections may be incorrect in the future. Forward-looking statements are not guarantees of future performance and you should avoid placing undue reliance upon them. This publication and all the information, opinions and conclusions contained herein are protected by copyright. This publication may not be reproduced in whole or in part without the prior express consent of The Bank of Nova Scotia.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer; their values change frequently, and past performance may not be repeated.

Investors holding funds in a non-registered account should be aware that distributions are taxable. The amount and the tax characteristics of distributions made to non-registered accounts will be reported on tax slips that will be sent to investors. Distributions made to registered accounts such as an RSP or RIF are not taxable.

Target distributions are not guaranteed and may change at any time at the discretion of the fund’s Manager. If distributions paid by the fund are greater than the net income and net capital gains of the fund, distributions paid may include a return of capital. A return of capital is not taxable to the investor but will generally reduce the adjusted cost base of the securities held for tax purposes. If the adjusted cost base falls below zero, investors will realize capital gains equal to the amount below zero. Distributions are automatically reinvested unless an investor elects to receive them in cash. Investors should not confuse a fund’s distribution rate with its performance, rate of return or yield. Distributions may consist of net income, and/or dividends, and/or net realized capital gains and are taxable in the hands of the investor. Target monthly distributions are determined based on the target payout rate for the indicated series of the fund. Monthly distributions are made by the last business day of each month, or the last business day of each calendar quarter for quarterly paying fund series, other than in December. The final distribution in respect of each taxation year will be paid or payable by December 31 of each year or at such other times as may be determined by the fund’s Manager.

ScotiaFunds® are managed by Scotia Global Asset Management. ScotiaFunds are available through Scotia Securities Inc. and from other dealers and advisors. Scotia Securities Inc. is wholly owned by The Bank of Nova Scotia and is a member of the Canadian Investment Regulatory Organization.

Scotia Global Asset Management is a business name used by 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank.

Scotiabank® includes The Bank of Nova Scotia and its subsidiaries and affiliates, including 1832 Asset Management L.P. and Scotia Securities Inc.

® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2025 The Bank of Nova Scotia. All rights reserved.