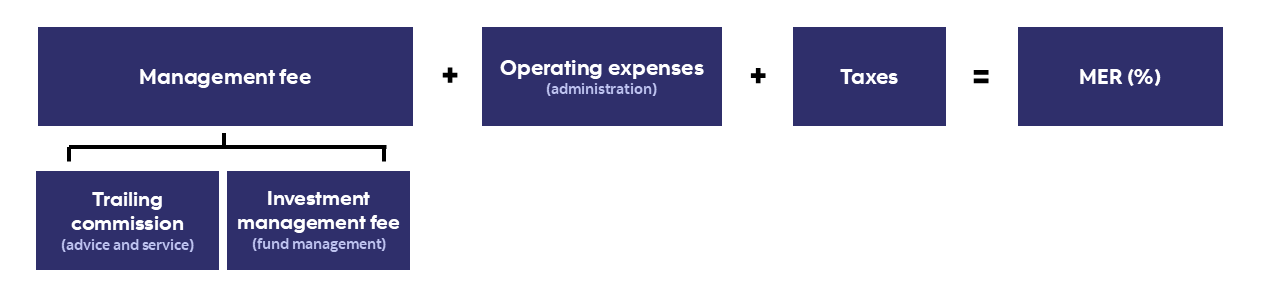

Investment management fee. This cost covers the professional expertise and services of portfolio managers who actively oversee and make decisions about your investments through a mutual fund. They monitor markets, research and analyze investment opportunities, adjust the portfolio to manage risk, and regularly optimize and rebalance the fund to ensure it remains aligned with its investment objectives.

Trailing commission. This pays for the personalized financial advice you get from your advisor like investment recommendations, portfolio reviews, and financial coaching through life’s ups and downs. It also pays for services like generating your investment statement and tax slips, and access to your investments through branches, contact centres, and online banking.

Fixed administration fee (or operating expenses). Pays for the behind-the-scenes cost of running the fund, like fund record keeping, administration, regulatory filings, and custodial services.

Taxes just like most services in Canada, taxes apply here too.

7 minute read

Investment fees are a key consideration when looking at different investment options, so it’s no surprise investors increasingly want to know: What am I paying for and is it worth it? It’s a fair question. And while it’s natural to focus on costs alone, it’s equally as important to understand the value that comes along with it. This article unpacks what’s included in the Management Expense Ratio of mutual funds, what investors receive in return, and clears up common misconceptions about mutual fund fees.

The annual cost of running a mutual fund is represented by the fund’s Management Expense Ratio (MER), which is expressed as a percentage of the fund’s assets. Think of the MER as a bundled fee that covers the essentials to keep your investment running smoothly and the advice you receive from your advisor. Here’s a breakdown of what’s covered in the MER (Figure 1):

Figure 1: What’s included in an MER?

There are the four main components to an MER:

A simplified way to approximate how much it costs to own a mutual fund annually is by multiplying the MER (%) by the total value of your investment in that fund. For example, a mutual fund with a MER of 1.73% would cost approximately $17.30 annually on a $1,000 investment (Figure 2). You can find detailed MER information for all ScotiaFunds in their Fund Facts document on Scotiafunds.com.

Figure 2: Calculate the annual cost

When you invest in a mutual fund, the MER covers a full suite of support, expertise, and tools designed to help you succeed. Mutual funds are one of the most popular investment products used by Canadian investors, and it’s easy to see why:

Convenience

Investing in a mutual fund saves you time from having to be your own financial advisor, portfolio manager, risk analyst, and more, so you don’t have to manage everything yourself.

Financial coaching

Just like in life, having a coach helps keep you on track. The same goes for your finances by having an advisor. 78% of Canadians say their financial advisor keeps them on track to meet their goals and 71% say their advisor helps them avoid making mistakes when buying and selling investments. *

Peace of mind

78% of Canadians say their primary advisor makes them feel confident about their financial situation. *

Professional investment management

Over the years, Canadian investors have continued to value having a professional manage their investments for them, with more than half of investors favouring this approach over time. *

Access to more

You also get access a personalized financial plan and/or retirement plan, and digital tools like Scotia Smart Investor to support your financial success.

| Misconception | Clarification |

| You pay the MER out-of-pocket | The MER is automatically deducted from the fund, it’s not a separate charge you pay |

| The MER is a one-time fee | The MER is paid for as long as you own the fund, calculated based on the value of your investment |

| The MER is only deducted when the fund makes money | The MER is deducted regardless of how the fund performs |

| The MER is deducted from the return shown on your statement or online | Returns on your investment statement and scotiafunds.com are provided net of MERs, meaning fees have already been deducted. |

| The lower the MER, the better the investment | The MER is just one piece of the picture. It shouldn’t overshadow other key factors like the fund’s strategy, risk level, return potential or how well it fits your financial goals. |

| A lower MER always means a lower total cost to invest | Series F (fee-based) funds typically have lower fees. That’s because they often have a separate account fee for ongoing advice and service that’s paid in addition to the MER. By comparison, Series A funds bundle the cost of advice into the MER. |

| Mutual funds are an expensive investment option | While mutual funds do have fees, they provide access to professional management, research, and diversification – services that can be costly, time-consuming, and complex to handle on your own. |

| The MER pays for all the costs associated with a mutual fund | While the majority of a fund’s fees are covered by the MER, some funds also charge a Trading Expense Ratio (TER). This pays for the costs of actively trading securities in the fund and can be found in the Fund Facts document. |

While there are fees you pay for investing in mutual funds, there’s a lot you get in return. If you are an existing mutual fund investor, here are three simple ways to make the most of what you’re already paying for:

Meet with your financial advisor.

Book a check-in today to review your current financial situation, investment portfolio and make sure your investments are aligned with your goals. Your advisor can also help answer questions or concerns you have about markets or your investments, offering tailored advice that reflects your unique situation and priorities.

Explore available investment tools and resources:

Ask your advisor to create or update your financial plan, explore digital tools like Scotia Smart Investor, and visit Scotiafunds.com to gain investment insights to help you stay informed and on track.

Rely on the professionals:

Spend more time enjoying life and less time worrying about investing. With mutual funds, there’s no need to monitor markets or stress about what to buy or sell. Leave it to the professionals, so you can focus on what matters most in your life knowing your investments are in good hands.

With the strength of one of Canada’s largest financial institutions, you benefit from the expertise of Scotia Global Asset Management’s team of investment professionals—like the Multi-Asset Management Team who manages Scotia Portfolio Solutions —who are dedicated to helping you grow and protect your wealth.

In conclusion, fees matter, but so does value. Mutual funds have earned their place as one of the most popular investment options in Canada and represent a cost-effective way to access professional investment management and personalized financial advice. Looking beyond the metaphorical price tag, you’ll likely find that what you’re paying for can be well worth it for the peace of mind, guidance, expertise, and support you receive to help you reach your financial goals.