7 minute read

2024 was nothing short of eventful. A transition year for interest rates, a backdrop of geopolitical tensions, and the ongoing artificial intelligence (AI) boom among other developments, the year kept investors on the edge of their seats. This article recaps top stories from the economy and financial markets, along with three investing lessons that, while not new, have come back into focus and should carry into 2025 and beyond.

Here’s what happened in 2024

Inflation cooled down

1.9%

Annual inflation rate in Canada

Inflation was red hot in 2023, but cooled significantly to finish the year below 2%. This level of inflation sits at the lower end of the Bank of Canada’s 2-3% target range, indicating that inflation has been reined back to “normal” levels for now. Phew!

Interest rates were slashed

-1.75%

Rate reductions by the Bank of Canada

The Bank of Canada cut its policy interest rate from 5% to 3.25%, offering welcome reprieve for borrowers feeling the pinch of high borrowing costs. Other major central banks followed suit, including the U.S. Federal Reserve, which cut rates by 75 basis points.

Canadian economy slowed

1.2%

Annual GDP growth

Canadian GDP growth slowed but remained positive for the year – while this might sound like bad news, it was widely expected. Higher interest rates in recent years have made borrowing more expensive, slowing consumer spending and investment, cooling economic growth.

"Big Tech" kept surging

49.0%

1-year return for the Information Technology sector

After lagging just a few years ago, technology stocks shined in 2024 to build on their comeback in 2023. The sector was pulled upwards by mega-cap stocks like Nvidia and Meta, which soared on the wave of excitement surrounding AI.

Bonds bounced back

4.2%

1-year return for Canadian bonds

Fixed income had a year of solid performance buoyed by falling interest rates. Bonds reaffirmed their position as an effective portfolio diversifier that can provide steady income and capital appreciation.

New year, new highs

17.2%

1-year return for a balanced portfolio

Disciplined investors were rewarded in 2024. Despite experiencing some short-term volatility in Q3, most major market indices closed the year at or near record highs –a reason to celebrate for those who stayed the course. Cheers to that!

Sources: Statistics Canada (Canada’s annual inflation rate, as represented by the Canadian Consumer Price Index), Bank of Canada (Canadian policy interest rate), The Federal Reserve Board (U.S. policy interest rate), Bank of Canada (Annual real GDP growth projection). Morningstar: 2024 calendar year returns for the U.S. Information Technology sector in the S&P 500 Composite Index, Canadian bonds as represented by the FTSE Canada Universe Bond Index, and illustrative Balanced portfolio which consists of a blend of 40% S&P/TSX Composite Index, 30% MSCI World GR Index, and 30% FTSE Canada Universe Bond Index). Assumes reinvestment of all income and no transaction costs or taxes. All returns are expressed in Canadian dollars and it is not possible to invest directly in an index. Securities mentioned are not buy/sell recommendations.

Top 3 investing lessons for 2025

Lesson #1: Don't let news headlines get you down

Markets saw remarkable performance in 2024 – take the U.S. stock market for example, which set more than 50 new record closing highs. At a quick glance, the year’s impressive performance might suggest that it was smooth sailing throughout the year; however, just like most years that came before, investors faced setbacks along the way, testing their resolve (Figure 1).

Figure 1: Fears versus facts

Markets shook off a spate of negative news throughout the year, recovering from short-term losses to set new all-time highs. Investors who let the media influence their decisions and withdrew their investments would’ve missed out on the significant gains that often followed.

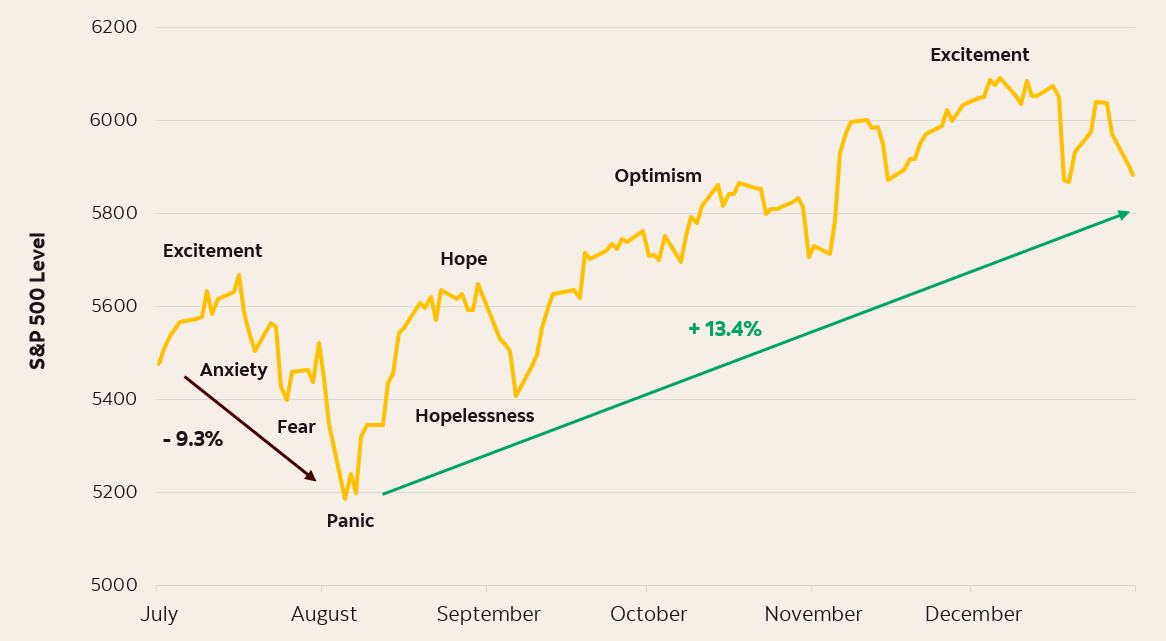

Lesson #2: Despite small setbacks, markets can make big comebacks

2024 wasn’t without its setbacks. This year’s largest market decline happened in August as markets dropped about 9% in the U.S. At the time, this dip felt more like a total collapse, due to the intense media coverage and headlines of a market crash which unsettled many investors. But, within weeks, markets recovered, and U.S. stocks went on to reach new all-time highs (see Figure 2).

It’s an important reminder that temporary declines in performance are a normal part of investing in the stock market. If you’re a long-term investor, you’ll inevitably experience several of these downturns in your lifetime. So, while it can be unnerving in the moment, it’s important to remember it’s par for the course.

Did you know?

2024’s largest market decline was milder than the average 13% intra-year drop we’ve seen over the past 15 years. But despite these annual dips, the market has delivered an average annual return of 11% during the same 15-year period.

Figure 2: The cycle of market emotions during a volatile year

Performance of U.S. stocks in the second half of 2024

Lesson #3: Stick to your asset mix

In today's investment landscape, an abundance of options can tempt you to question your strategy and change your asset allocation. With high-interest savings accounts and GICs offering attractive interest rates and negative headlines dominating the news, many investors changed course and moved their investments to cash. But changing your long-term asset mix in favour of short-term investments would have left your portfolio worse off in 2024 (see Figure 3).

Figure 3: Portfolio value by year’s end

$10,000 invested 3 different ways in 2024

Did you know?

The start of a new year is a good time to review and rebalance your portfolio. If you're invested in a Scotia Portfolio Solution, sit back and relax – this is done for you automatically by a team of professionals!

Today’s knowledge, tomorrow’s advantage

Investing lessons have a way of coming back around, so don’t just learn it and leave it. After all, 2024’s lessons weren’t new, but served as reminders of timeless investing principles: tune out the noise, remain patient, and maintain a well-diversified investment strategy. Ultimately, it's not about reacting to every market twist and turn but staying the course and keeping your long-term goals in focus. As we turn the page to the new year, connect with your Scotiabank advisor to turn 2024’s investing lessons into 2025’s wins.