Are you emotionally invested?

Pioneers in the study of behavioural finance have identified biases that can contribute to investors’ unpredictable and often detrimental financial decision-making behaviour. Emotions like fear, greed, anxiety, and overconfidence can drive even the savviest of investors to make emotionally-driven investment decisions. Let’s examine how common emotional biases can unconsciously sway our investment decisions, and what we can do to manage their influence.

1. Regret Aversion

Popularly referred to as the Fear of Missing Out (FOMO), regret aversion creeps up in our everyday lives in all sorts of ways- like impulse buying a trendy item or attending a social event simply to feel included. Similarly, investors can also experience FOMO, which can tempt them into purchasing investments even if they don’t align with their risk tolerance. For example, media buzz and word-of-mouth enticed many to invest in cryptocurrencies, in fear of missing out on its promise of “limitless” upside potential. Unfortunately, many ended up experiencing uncomfortable levels of loss and selling at record lows due to their inability to withstand the risk involved.

What can you do?

- Tune out market noise. Don’t let news headlines or media hype steer you off course. These sources can often be sensationalized, misleading or even outright false, so avoid giving them the power to trigger “in the moment” buying and selling.

- Play the long game and stick to the plan. Stay focused on the big picture with a well-defined investment plan that thoughtfully aligns your financial needs and emotional needs.

2. Familiarity Bias

In investing, familiarity bias is the tendency to gravitate towards assets you’re well-acquainted with, typically because of the sense of comfort they bring, compared to discomfort with the unknown. This can include investing in stocks, bonds, and other investments you already own or investments that are discussed favourably in the news. It can also include only investing in companies and securities in the country you live in, called home country bias. Familiarity bias can lead to holding a concentrated portfolio in a smaller set of assets that you're familiar with, limiting diversification and forgoing investment opportunities that other asset classes and global securities can provide (see Figure 1).

What can you do?

- Don’t put all your eggs in one basket. Diversifying your investments across asset classes, sectors, and geographies can help you reach your financial goals quicker, while simultaneously reducing risk and helping mitigate losses in times of market volatility.

- Seek financial advice. A financial advisor can offer an objective viewpoint, helping you make balanced investment decisions. Your advisor can discuss a broad range of investment options that incorporate the principles of asset allocation and diversification for a well-constructed portfolio that minimizes concentration risk.

Figure 1: A world of opportunity

Source: Morningstar. Annual total returns in Canadian currency as of December 31, 2023. Assumes reinvestment of all income and no transaction costs or taxes. Annual returns compounded monthly. The information is for illustrative purposes only. It is not possible to invest directly in an index.

3. Disposition Bias

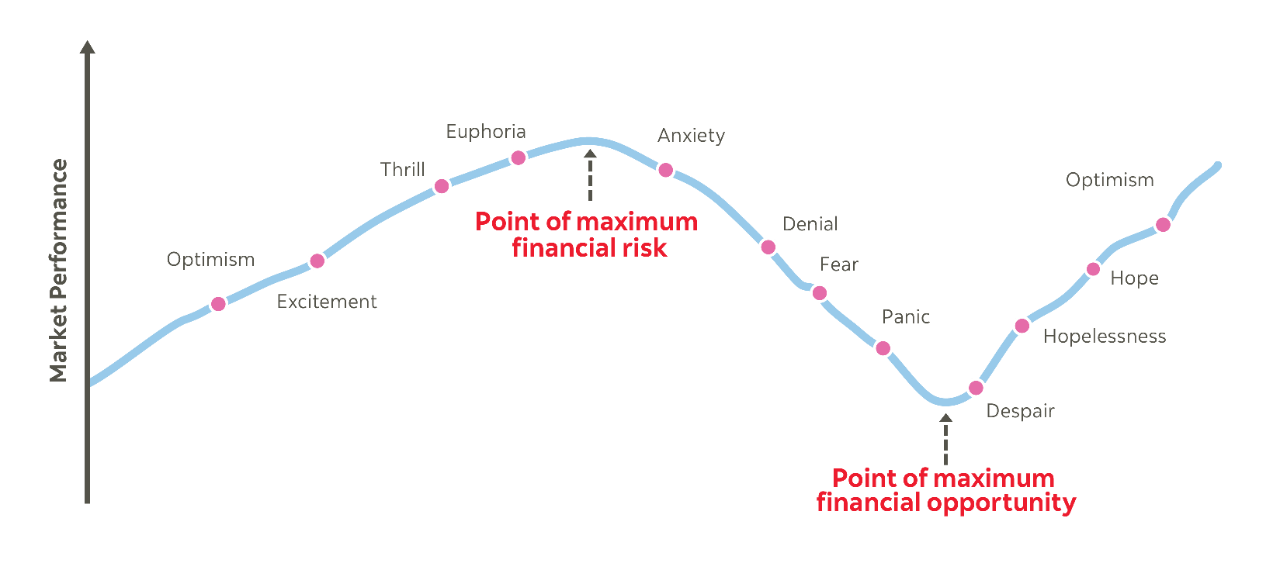

Disposition bias refers to the tendency to sell profitable investments too early and hold on to poor performers for too long. Investors generally feel a financial loss about 2.5 times stronger than a gain of the same magnitude.* Simply put, we’re hard wired to avoid losses. In reality, market downturns are a normal and healthy part of a regular business cycle. For some, the ups and downs of the market can make investing feel like an emotional rollercoaster (See Figure 2). Whether it's the thrill of a big win or the pain of a significant loss, our emotions can often trigger investment decisions that work against our long-term goals.

Figure 2: Cycle of market emotions

Source: Darst, David M. (Morgan Stanley and Companies, Inc.). The Art of Asset Allocation, 2003.

What can you do?

- Don’t watch markets daily. This encourages noise trading – buying or selling without analysis. A well-designed financial plan can help you look past everyday stock market fluctuations and focus on the long term.

- Focus on the positive. View market downturns as an opportunity to purchase investments at a discount. Investing automatically with a Pre-Authorized Contribution (PAC) can help you do so, through dollar-cost averaging.

4. Anchoring Bias

Anchoring bias is the tendency to rely on the first piece of information we get and use it as a reference point to base future decisions, even if the information is irrelevant or arbitrary. Anchoring may lead investors to hold a security that is no longer fundamentally sound based off prior information, such as the original purchase price, that may no longer be accurate or relevant. On the contrary, it can also mean missing out on investment opportunities based off old news headlines.

What can you do?

- Leverage the professionals. Mutual funds and portfolio solutions are managed by professional portfolio managers who handle investment decisions for you, based off objective market research, company fundamentals, the market environment, and other relevant factors.

Behavioural Finance 101

In addition to those covered in this article, here are a number of other psychological biases that can influence investment decisions.

Be mindful of your emotions

Do your best to keep these emotional biases at bay the next time you’re considering a new investment opportunity. Reflect and ask yourself: is your decision-making driven by emotion, or rooted in investing fundamentals based off your long-term investment plan?

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently, and past performance may not be repeated.

This document has been prepared by Scotia Global Asset Management and is provided for information purposes only.

Views expressed regarding a particular investment, economy, industry or market sector should not be considered an indication of trading intent of any of the mutual funds managed by Scotia Global Asset Management. These views are not to be relied upon as investment advice nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based upon markets and other conditions, and we disclaim any responsibility to update such views. Information contained in this document, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice and Scotia Global Asset Management is not responsible to update this information.

To the extent this document contains information or data obtained from third party sources, it is believed to be accurate and reliable as of the date of publication, but Scotia Global Asset Management does not guarantee its accuracy or reliability. Nothing in this document is or should be relied upon as a promise to ensure that individual circumstances are considered properly, and action is taken based on the latest available information.

Scotiabank® includes The Bank of Nova Scotia and its subsidiaries and affiliates, including 1832 Asset Management L.P. and Scotia Securities Inc.

Scotia Global Asset Management® is a business name used by 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank.

® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2024 The Bank of Nova Scotia. All rights reserved.