5 timeless tips on managing market ups and downs

Market volatility can be unsettling, for even the savviest of investors. In this article we provide you with some tips on how to manage – and potentially benefit from – market volatility.

May 22, 2025

9 minute read

Investing in a stock market without volatility is as illusory as driving a car without an engine. Like it or not, the two concepts invariably go hand in hand. But does that mean you should avoid volatility and investing altogether?

The short answer is no. Market uncertainty can naturally cause panic and lead to poor investment decisions. Yet, by recognizing short-term market uncertainty for what it is, you can help ensure that it doesn’t derail your long-term goals.

Here are five tried and tested principles that can help you gain needed perspective.

Investing is most intelligent when it is most businesslike.

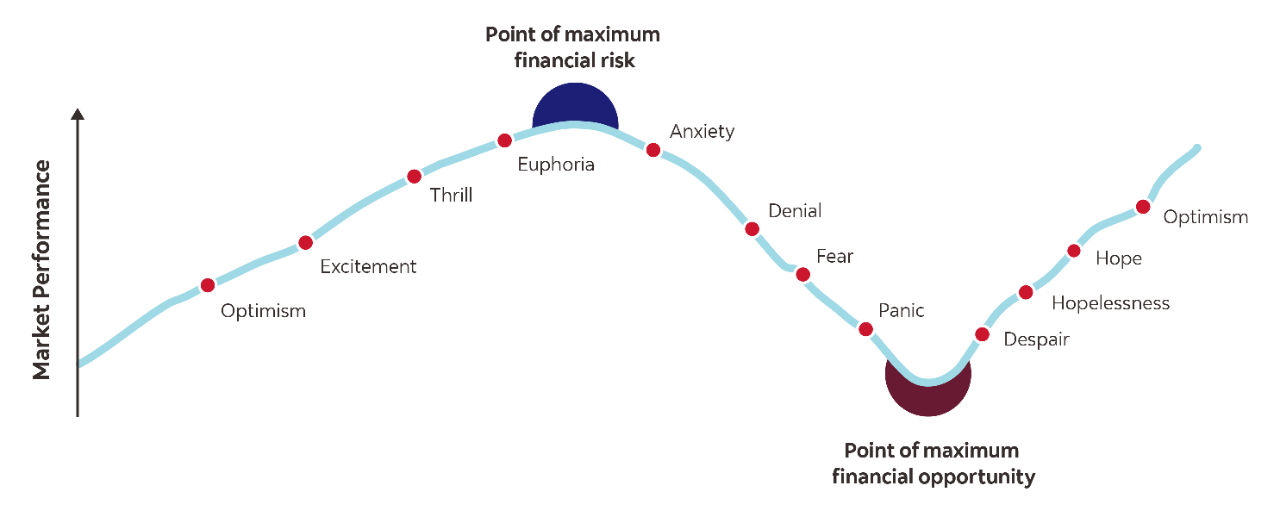

Investors generally feel a financial loss about two and a half times more than a gain of the same magnitude. Understandably, many of us experience a roller coaster of emotions when investing (see Figure 1), which can translate into poor buy and sell decisions.

Being aware of these emotions during periods of increased volatility can help you avoid panic, keep calm, remain disciplined and focused on reaching your long-term goals.

Figure 1: Cycle of market emotions

Source: Darst, David M. (Morgan Stanley and Companies, Inc.). The Art of Asset Allocation, 2003.

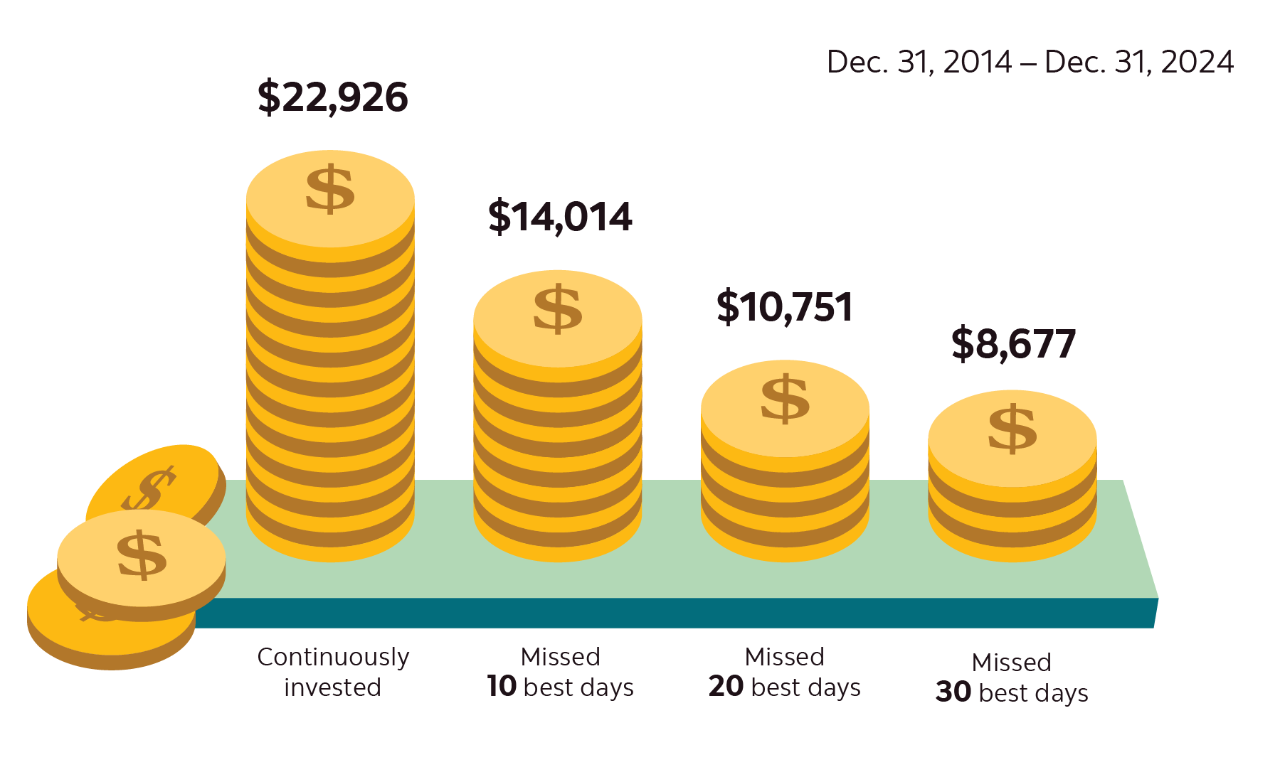

Trying to time the ups and downs of the market is a bit like the roll of a dice. Consider the impact of missing the best 10, 20 and 30 days on the value of $10,000 invested in Canadian stocks over the past 10 years.

As Figure 2 shows, sitting on the sidelines can be costly. Over a 10-year period if you’re out of the market for even a small number of days when the market is outperforming, you can substantially reduce your return potential.

Staying invested – while not always easy – can potentially translate into a better outcome.

Figure 2: Staying invested

Source: Morningstar. For illustrative purposes only. S&P/TSX Composite TR Index, 10-year period ending December 31, 2024. It is not possible to invest directly in an index. Assumes reinvestment of all income and no transaction costs or taxes. Value of investment calculated using compounded daily returns. Missing the 10, 20 and 30 best days excludes the top respective return days.

Risk can be a loaded term when it comes to investing and is often misunderstood. You often hear about risk and volatility in investment parlance, the two concepts are related but are not the same thing.

Risk refers to the degree of uncertainty and/or potential financial loss inherent in an investment decision. On the other hand, volatility simply measures how much the return of an investment or the broader market fluctuates up and down. While some may fixate on these fluctuations, the permanent loss of capital should be of greater concern. Reducing exposure to securities that are perceived as ‘risky’ will certainly lower market risk. Still, by doing so, long-term investors could potentially see the purchasing power of their savings erode faster and outlive their savings quicker.

Whether we like it or not, risk and investing in the stock market are a package deal. The key to long-term success is managing your risk exposure by using time and diversification to your advantage.

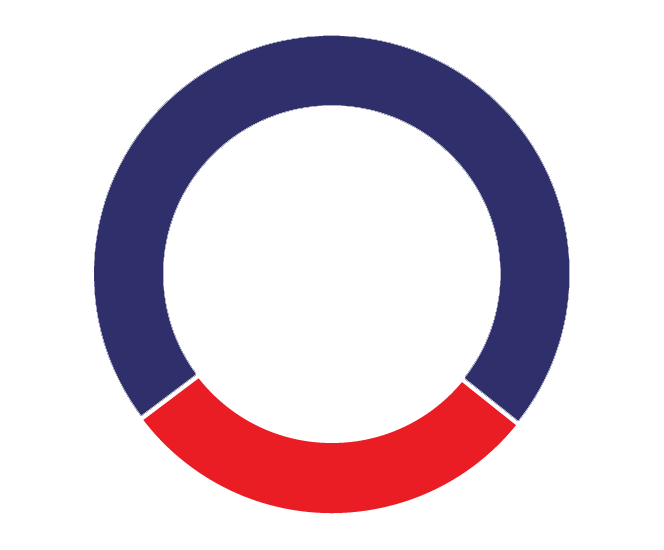

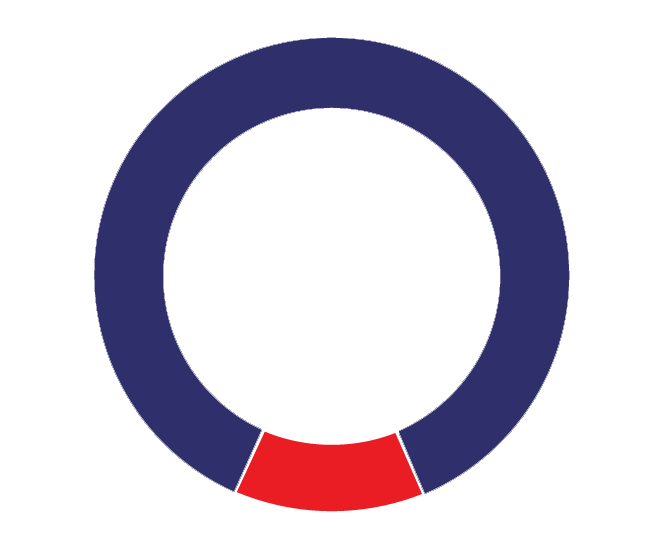

Figure 3: All Equity and balanced portfolio, 1-year

Figure 3 shows the calendar-year returns for a hypothetical All Equity and a Balanced Portfolio. It shows that while the performance of any portfolio can swing significantly each year, a Balanced Portfolio has historically resulted in fewer negative returns compared to an All Equity portfolio over the long term.

All Equity Portfolio - 1-Year1

28%

18 occurrences

Worst year:

2008 ⇩ -33.0%

72%

46 occurrences

Best year:

1979 ⇧ +44.8%

Balanced Portfolio - 1-Year3

20%

13 occurrences

Worst year:

1974 ⇩ -14.8%

80%

51 occurrences

Best year:

1993 ⇧ +25.3%

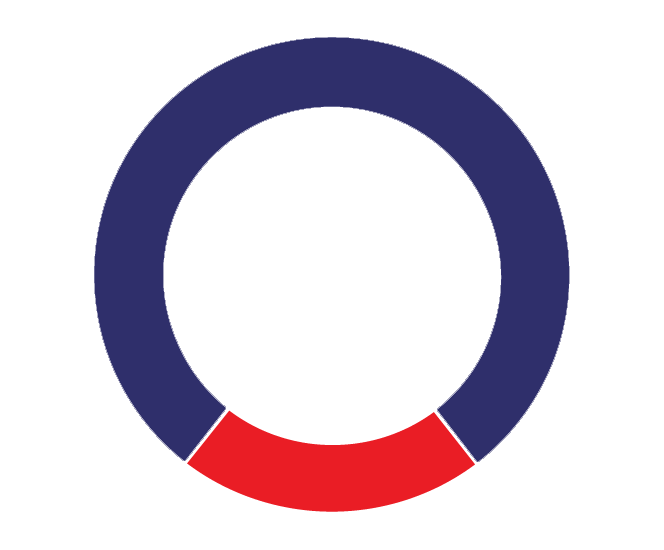

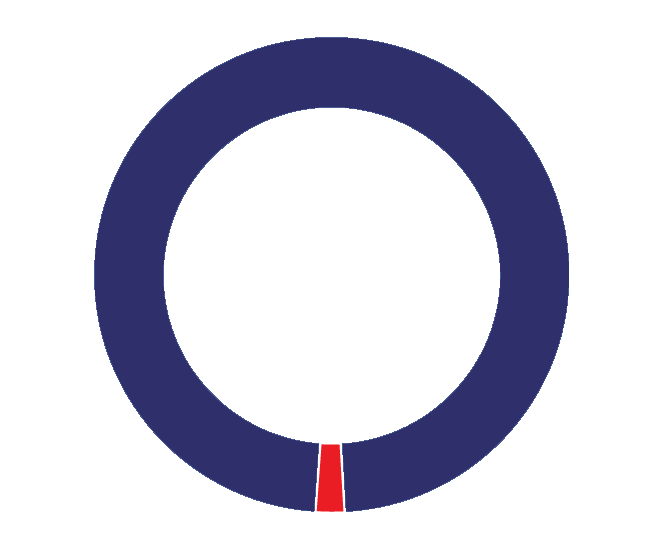

Figure 4: All Equity and balanced portfolio, 3-year

When you look at the performance of the same two portfolios over a 3-year period (Figure 4), the frequency of negative occurrences significantly declines, highlighting the positive impact of time in further reducing volatility.

All Equity Portfolio - 3-Year2

13%

8 occurrences

Worst year:

2002 ⇩ -6.3%

87%

54 occurrences

Best year:

1980 ⇧ +34.7%

Balanced Portfolio - 3-Year4

2%

1 occurrence

Worst year:

1975 ⇩ -0.4%

98%

61 occurrences

Best year:

1980 ⇧ +18.5%

Red = negative occurrences

Blue = positive occurrences

Source: Morningstar. Returns are calculated in Canadian currency. Assumes reinvestment of all income and no transaction costs or taxes. The portfolios are for illustrative purposes only. It is not possible to invest directly in an index.

1Based on the calendar year returns of the S&P/TSX Composite Total Return Index from 1960 to 2024.

2Based on 3-year annualized returns ending December 31 of the S&P/TSX Composite Total Return Index from 1960 to 2024.

3Based on the calendar year returns of a portfolio of 50% the S&P/TSX Composite Total Return Index and 50% Canadian Fixed Income Composite from 1960 to 2024.

4Based on 3-year annualized returns ending December 31 of a portfolio of 50% the S&P/TSX Composite Total Return Index and 50% Canadian Fixed Income Composite from 1960 to 2024.

Canadian Fixed Income Composite consists of 80% FTSE Canada LT Bond & 20% FTSE Canada Residential Mortgage Index from 1960 to 1979; 100% FTSE Canada Universe Bond Index from 1980 to 2024.

Best and worst year rates of return based on each time period specified.

Like the familiar adage, “Don’t put all your eggs in one basket,” diversification is a tried-and-tested technique that mixes different types of investments in a portfolio to lower risk. No single asset class is consistently among the top performers, and the best and worst performers can change from one year to the next.

By including investments that are less correlated to one another – or react differently to economic and market events – gains in some can help offset losses in others. As Figure 5 illustrates, a diversified portfolio with different asset classes provides the opportunity to participate in potential gains of each year’s top winners while aiming to lessen the negative impact of those at the bottom.

Figure 5: Calendar year returns (in Canadian dollars)

Source: Morningstar. Priced in Canadian currency, as of December 31, 2024. Assumes reinvestment of all income and no transaction costs or taxes. Annual returns compounded monthly. The asset classes are represented by their indicated indices and the balanced portfolio is illustrative in nature and was rebalanced monthly. This information is for illustrative purposes only. It is not possible to invest directly in an index. Diversification does not guarantee a profit or eliminate the risk of loss.

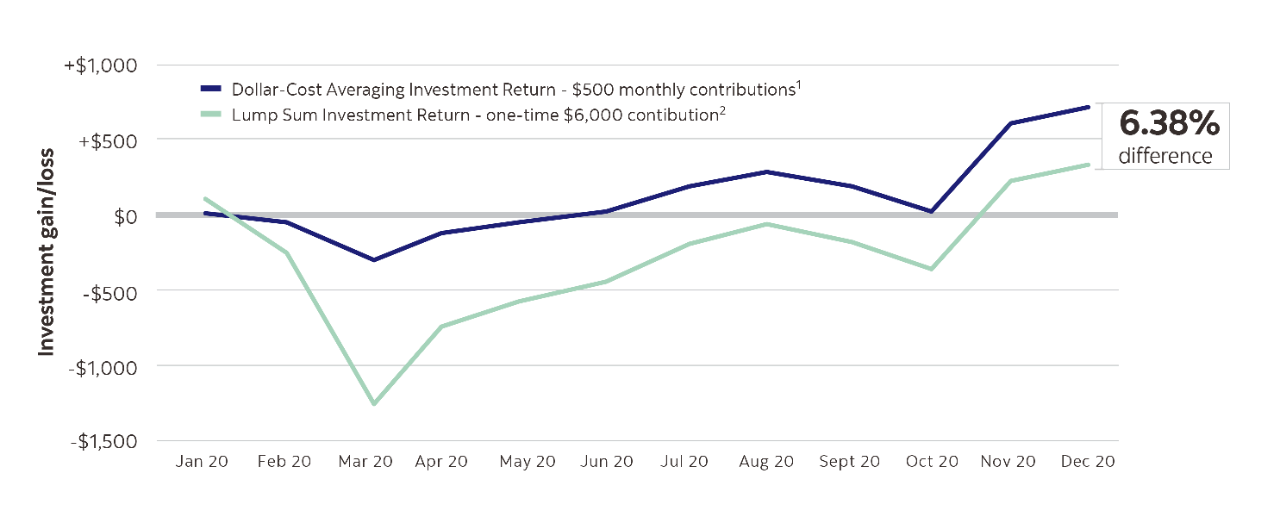

Dollar-cost averaging (DCA) is an investment method used to help reduce the risk of timing a lump-sum investment. By investing a fixed dollar amount regularly, the dollar-cost averaging process helps control the effect of market volatility by smoothing out the average cost per unit of mutual funds purchased.

Over time, and in certain market conditions, it could result in a lower average cost and a higher return. Figure 6 illustrates how a dollar-cost-averaging strategy compares to a lump sum purchase in 2020, a period punctuated by extreme market volatility and a significant correction.

While it’s important to note that DCA doesn’t always produce a higher return versus lump sum investing, this systematic approach can help investors stay the course by taking the guesswork out of when to invest.

Figure 6: Dollar-cost averaging

Source: Scotia Global Asset Management and Morningstar. Based on an illustrative investment in the S&P/TSX Composite Total Return Index. It is not possible to invest directly in an index.

1 Dollar-Cost Averaging illustration assumes 12 contributions of $500/month made between January 1, 2020 and December 31, 2020, totalling $6,000 in contributions.

2 Lump Sum illustration assumes a one-time $6,000 contribution was made on January 1, 2020. The year 2020 was used for illustrative purposes as the benefits of dollar-cost averaging were prominently demonstrated.

Short-term market ups and downs can cause even the most experienced of investors to lose sight of the big picture. An advisor can help you develop a financial plan, recommend suitable investments and navigate rough waters.

In fact, research on the value of advice has shown that investors find they have better savings and investment habits because of their advisor and more than twice the wealth compared to those who don’t have an advisor.1,2

With the help of your advisor, understanding your initial reactions to market ups and downs can help you make better investment choices, view your portfolio more objectively, stay the course and ultimately reach your goals.

Helping you make better investment decisions

77% of mutual fund investors say that they have better saving and investment habits because of their advisor.1

Getting advice pays off

2 out of 3 Canadian investors (64%) who work with an advisor say they are better off financially than if they managed their money on their own.3

Keeping you on track to success

78% of Canadian investors who use an advisor say their advisor keeps them on track to meet their goals.3

Providing peace of mind with a plan

88% of investors who use an advisor and have a written financial plan feel confident they will achieve their investment goals.3

Sources:

1Pollara Mutual Fund and ETF Investor Survey (October 2023).

2More on the Value of Financial Advisors, Claude Montmarquette, Alexandre Prud'Homme, CIRANO 2020. Compared to non-advised households, the average household with a financial advisor accumulated 2.3 times more financial assets over periods greater than 15 years (March 2020).

3Scotia Global Asset Management Investor Sentiment Survey (November 2023).

Just like the weather, markets can be unpredictable

So, what can you do when markets look gloomy? Here are key tips to help you manage – and even potentially benefit from – market volatility.

Insert heading text

with an optional subtitleThis document is also available for download as PDF

Staying invested during market ups and downs is simple – but not always easy.

Contact your Scotiabank advisor today to develop a plan that makes sense for you.

Book an appointment with a Scotia advisor.

It starts with a simple conversation.

Have a question?

We’re ready to give you advice.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently, and past performance may not be repeated.

This document has been prepared by Scotia Global Asset Management and is provided for information purposes only.

Views expressed regarding a particular investment, economy, industry, or market sector should not be considered an indication of the trading intent of any of the mutual funds managed by Scotia Global Asset Management. These views are not to be relied upon as investment advice, nor should they be considered a recommendation to buy or sell. These views are subject to change at any time based on markets and other conditions, and we disclaim any responsibility to update such views. Information contained in this document, including information relating to interest rates, market conditions, tax rules, and other investment factors are subject to change without notice, and Scotia Global Asset Management is not responsible to update this information. Nothing in this document is or should be relied upon as a promise or representation as to the future.

ScotiaFunds® are managed by Scotia Global Asset Management. ScotiaFunds are available through Scotia Securities Inc. and from other dealers and advisors, including ScotiaMcLeod® and Scotia iTRADE®, which are divisions of Scotia Capital Inc. Scotia Securities Inc. and Scotia Capital Inc. are wholly owned by The Bank of Nova Scotia. Scotia Capital Inc. is a member of the Canadian Investor Protection Fund and the Canadian Investment Regulatory Organization.

Scotia Global Asset Management® is a business name used by 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank.

® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2025 The Bank of Nova Scotia. All rights reserved.