VIX Index

The VIX, or "fear index," gauges expected market volatility over the next 30 days using S&P 500 index options prices. It rises with anticipated significant price swings, indicating increased investor fear, and falls during calmer market conditions with less expected volatility.

6 minute read

The 2024 presidential race, once anticipated as a showdown between Democratic President Joe Biden and former Republican President Donald Trump, has taken some unexpected turns. With Biden's surprise withdrawal and endorsement of Vice President Kamala Harris as the Democratic nominee, the political landscape has shifted. While no two elections are exactly the same, history shows election outcomes have less influence on long-term market performance than investors may think.

Elections sway voters more than markets

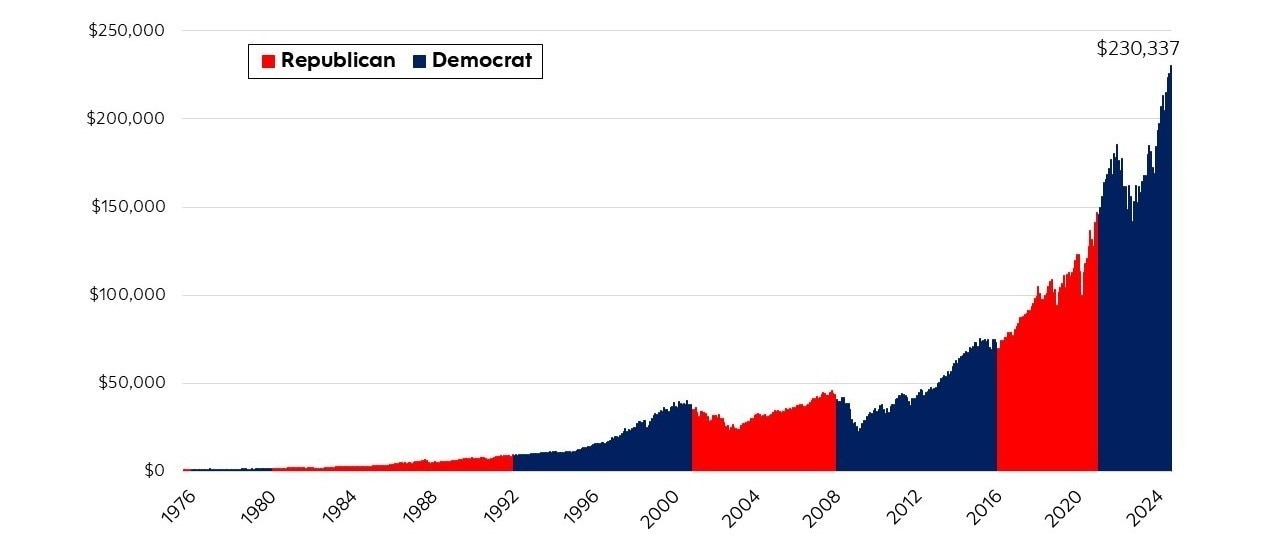

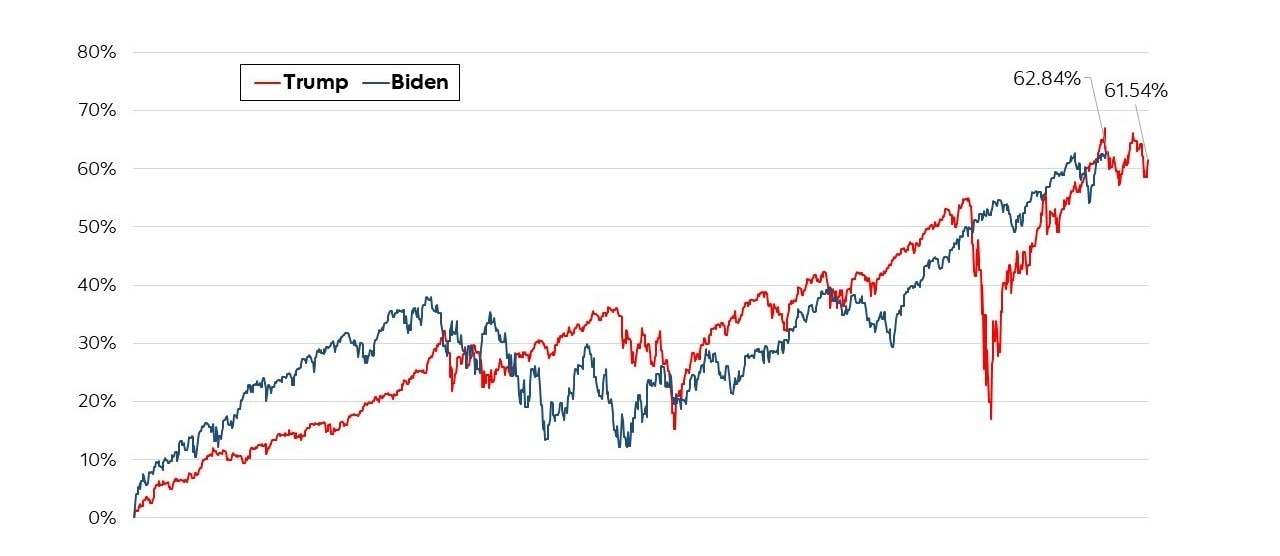

Many investors can feel jittery in election years, concerned how election results might sway their investment portfolios. Some even consider hitting the pause button on investing altogether to avoid uncertainty. Taking a closer look, history shows markets don’t pick political favourites, and over the long-term have performed well under both Democratic and Republican leadership (Figure 1A). And despite changes in governing parties and various political events, markets have maintained their long-term upward trajectory, demonstrating resilience to short-term political shifts (Figure 1B).

Over the past 50 years, $1,000 invested in the S&P 500 would have grown more than $230,000, demonstrating the market's resilience through numerous political changes. This remarkable growth occurred despite multiple transitions between Republican and Democratic administrations, and various economic policies.

Economic trends trump electoral outcomes

While elections can influence fiscal policy and, by extension, financial markets, the broader economy plays a much more significant role in steering market direction. As election day approaches, Canada and the U.S. are showing signs of economic strength:

- Inflation has significantly decreased

- Consumer spending continues to be strong

- Corporate earnings are robust, particularly among large-cap companies

- Economic growth has slowed but still surpassed expectations

- Additional monetary policy easing and rate cuts could further stimulate growth spending

* As of September 1, 2024.

Don't bet your portfolio on polls or predictions

Positioning an investment portfolio based on an expected election outcome is rife with uncertainty. Not only is it challenging to correctly guess who'll be the election winner, it’s even more difficult to gauge the resulting winning investments.

An example from the not-too-distant past

Expectations

During the 2016 election, most experts were convinced that democratic presidential nominee Hillary Clinton would win. Experts also predicted that in the unlikely event of a Trump win, markets would collapse.

Reality

Not only did Trump win the election, but the S&P 500 index rallied nearly 30% in the 12 months that followed.

Both of these leading predictions proved to be wrong. And investors who avoided investing in the stock market based on these forecasts missed out on significant gains, underscoring the costly consequences of market timing based on political speculation.

Historically, U.S. elections have caused short-term market volatility but had minimal long-term impact. Policy shifts between parties are typically minor, rarely affecting companies' growth rates or long-term profitability. As long-term investors, we don't alter investments based on speculated political outcomes or anticipated policy changes. While responding to change is important, speculating on binary outcomes is not a secure strategy.

Election buzz may increase market volatility, but it’s unlikely to disrupt long-term performance

While political headlines may trigger short-term market fluctuations, the long-term performance of stocks is primarily driven by their fundamentals. Over the past 75 years, 18 presidential elections have occurred, with U.S. stocks showing positive performance in 16 of those years (89%).

During U.S. election years, it's typical for the VIX Index, a measure of stock market volatility, to show an uptick in the months leading up to the election day. While volatility can increase as election day approaches, it has historically subsided immediately afterward - underscoring the importance of maintaining a long-term perspective, rather than acting on short-term political noise when making investment decisions.

With markets thriving under various political administrations and typically overcoming short-term volatility caused by presidential elections, investors should resist the urge to time the market based on political outcomes. Instead, investors are better served by maintaining focus on their long-term financial goals and staying committed to their investment strategy throughout election cycles.

Source: Morningstar. U.S. stocks are represented by the S&P 500. Indices are not managed, and it is not possible to invest directly in an index. Assumes reinvestment of all income and no transaction costs, fees, or taxes.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently and past performance may not be repeated.

This document has been prepared by Scotia Global Asset Management and is provided for information purposes only.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Nothing in this document is or should be relied upon as a promise or representation as to the future. Indices are not managed and it is not possible to invest directly in an index.

ScotiaFunds® and Dynamic Funds® are managed by Scotia Global Asset Management, a limited partnership the general partner of which is wholly owned by The Bank of Nova Scotia. ScotiaFunds and Dynamic Funds are available through Scotia Securities Inc. and from other dealers and advisors. Scotia Securities Inc. is wholly owned by The Bank of Nova Scotia and is a member of the Canadian Investment Regulatory Organization.

Scotiabank® includes The Bank of Nova Scotia and its subsidiaries and affiliates, including Scotia Global Asset Management and Scotia Securities Inc. Scotia Global Asset Management® is a business name used by 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank. ® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2024 The Bank of Nova Scotia. All rights reserved.