5 minute read

The comfort and simplicity of cash can be enticing; it’s tangible, easily accessible, and feels safe. While cash can be useful for short-term needs like daily spending or emergency savings, it can come with a significant – and often hidden – cost for long-term investors. In this article, we challenge the notion that “cash is king,” uncovering the pitfalls of holding too much cash and how it can negatively impact your long-term investment returns.

The cash drag

When it comes to cash in your long-term portfolio, less is often more. As markets rise, cash can struggle to keep up with other asset classes like stocks or bonds. Holding too much cash can limit how much your entire portfolio can grow in value over time. Think of it like carrying a heavy backpack while running a marathon – it’ll slow you down.

Figure 1: Cash can damper long-term growth

Over longer time periods, cash significantly underperforms, which can lead to falling short of your goals. The higher the allocation to cash, the bigger the drag it can have on your overall portfolio returns (Figure 1).

Managing risk doesn’t mean avoiding it

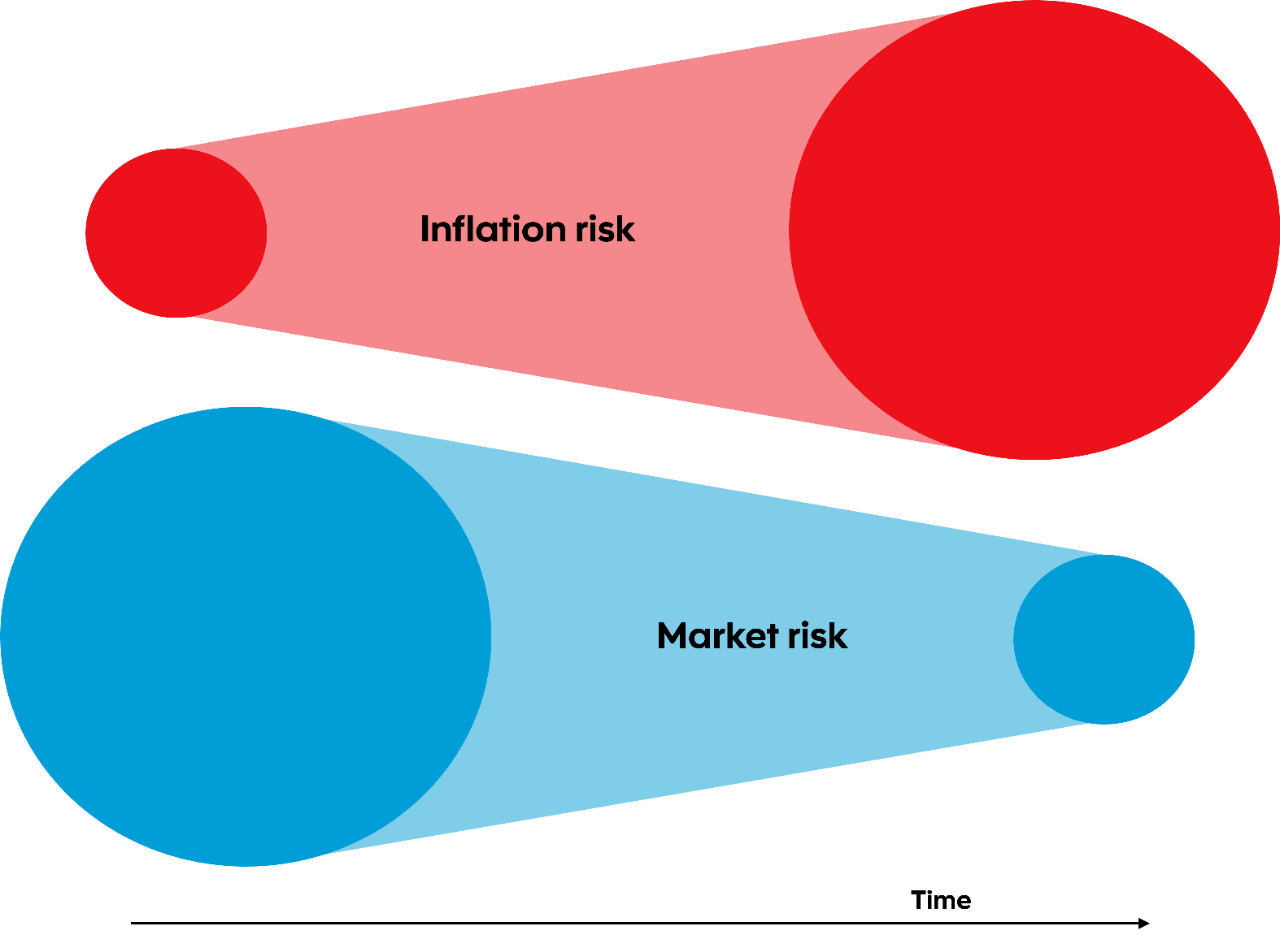

It’s a common misconception that cash is risk-free. While cash can provide stability as its value doesn’t fluctuate as much as other asset classes (called market risk), its value also often doesn’t go up much over time either, subjecting you to inflation risk (see Figure 2).

Figure 2: Putting risk into perspective

If you’ve felt the pinch of higher costs for goods and services at the cash register, you’re familiar with the concept of inflation. Inflation risk grows over time as costs keep rising, meaning it can have an even bigger impact on your savings over longer periods of time. If your cash doesn’t keep up with rising prices, you’ll lose purchasing power. That means cash can have a negative real rate of return after being adjusted for inflation.

Market risk refers to risk factors that affect financial markets as a whole, including the potential for an investment to decline in value during periods of market volatility. In the moment, this may feel uncomfortable, but over time, the ups and downs can often feel like small bumps in the road as you progress towards your investment goal.

Apply the Goldilocks principle

The degree of risk you’re willing to accept when investing is a critical factor in building a successful investment plan. While an aggressive investment strategy can be too much for many to stomach, an overly conservative approach of keeping your savings in cash can hinder growth potential and increase the risk of falling short of goals, especially after factoring in inflation. Instead of parking funds in cash in an attempt to manage risk, consider a more strategic approach. Scotia Portfolio Solutions are available in a range of strategic asset allocations that are regularly rebalanced to maintain a level of risk you’re comfortable with. A Scotiabank advisor can recommend a portfolio that’s “not too hot, not too cold, but just right” to meet your unique needs.

Is your money working as hard as you do?

You work hard for your money, and your investments should work hard too. Here are some questions you can ask to determine if your cash is working for you:

- Is your allocation to cash intentional? Was this cash set aside for a specific purpose, or did you mean to invest it? If the latter, take action today to put your money to work for you.

- Does your cash allocation match your investor profile and risk tolerance? Are you willing to accept lower returns for perceived safety? Review your investor profile with your advisor to determine if there’s an investment strategy that can serve you better.

- Could your excess cash be put to better use? If you have a surplus of cash, when will you need access to it? Consider investing it according to your time horizon and risk tolerance.

The bottom line

When it comes to investing for the long-term, it’s hard to reach your destination when your hard-earned savings are sitting idly as cash. With inflation falling and central banks poised to cut interest rates in 2024, the changing investment landscape is sending a clear message: it’s time to consider shifting your cash into high gear. A Scotiabank advisor can review your financial plan and investing strategy to help you stay on track with reaching your financial goals.

® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2024 Scotia Global Asset Management. All rights reserved. As used in this document, the term “Scotiabank advisor” refers to a Scotia Securities Inc. mutual fund representative or, in Quebec, a Group Savings Plan Dealer Representative. When you purchase mutual funds or other investments or services through 1832 Asset Management L.P. and Scotia Securities Inc.