Fixed income

Fixed income (also known as bonds) investments pay regular coupon payments until maturity, at which point the bond holder receives a final coupon payment and the original face value back.

Regular payments

Regular coupon payments represent the interest income that the bondholder receives periodically from the bond issuer. For example, a bond with a face value of $1,000 and an assumed annual coupon rate of 5%, will yield $50 in regular coupon payments each year.

Bond price change

Just like stocks, bonds can be bought and sold. Selling a bond for more than what it was bought for results in a profit while selling it for less results in a loss. Alternatively, a bond can be held to maturity at which point the bondholder gets the original face value returned (no price change).

Recency bias

The tendency to overemphasize the importance of recent experience or latest information in estimating future events.

8 minute read

And so it begins – after years of restrictive monetary policy, central banks have started to cut interest rates, offering a welcome reprieve for borrowers feeling the pinch of high borrowing costs. And fixed income investors have something to be happy about, too.

As interest rates soared and sat at decade highs in recent years, bond markets have been challenged. Thankfully, a reversal of interest rates can be a boon for fixed income investors. With central banks pivoting from rate hikes to cuts, Scotia Global Asset Management’s Multi-Asset Management Team is more optimistic about the forward-looking return potential for fixed income than they’ve been in several years.

What’s a bond and how does it work?

Think of fixed income (also known as bonds) like an I Owe You “IOU”. Companies and governments issue bonds to raise funds from investors willing to lend them money for a certain amount of time. In return, the bond issuer pays them regular payments on a “fixed” schedule, hence the name “fixed income”. A bond’s total return is a function of two main components: those regular payments and any price change if the bond is sold before it matures (see Figure 1). So, we know how bonds work, what makes bonds so interesting now?

Figure 1: Lifecycle of a bond

Interest rates and bond prices: every action has an opposite reaction

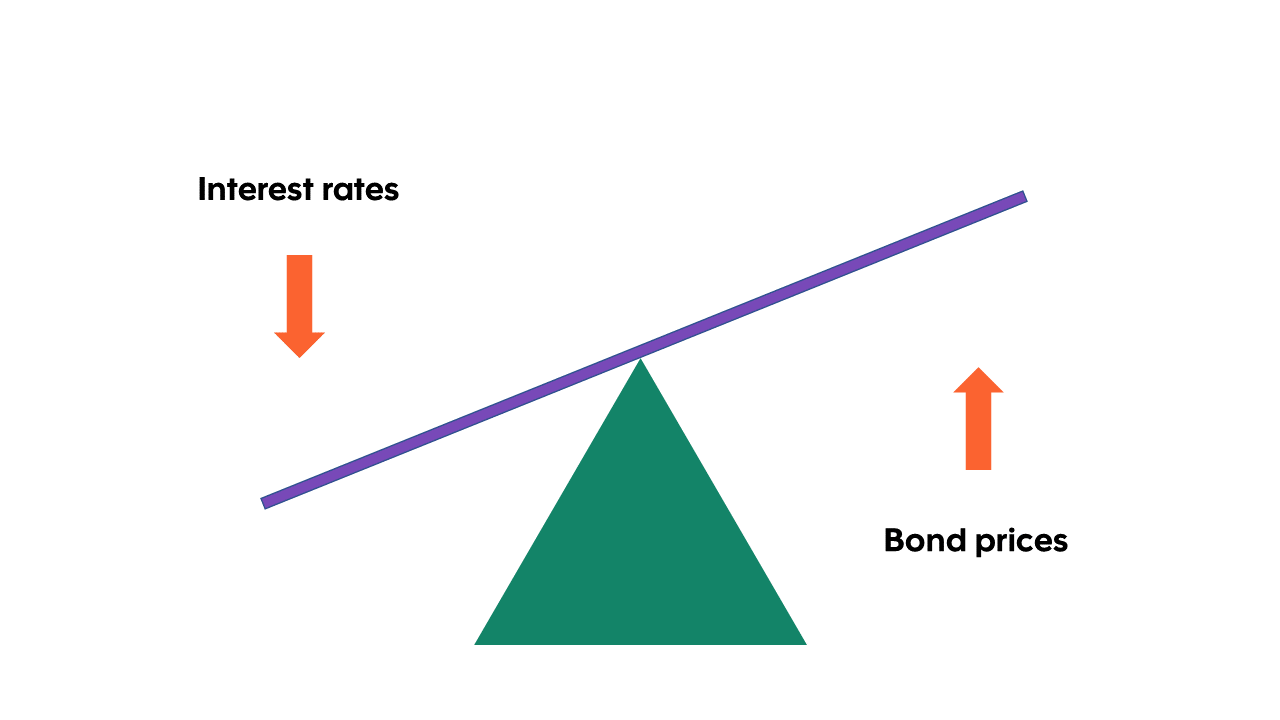

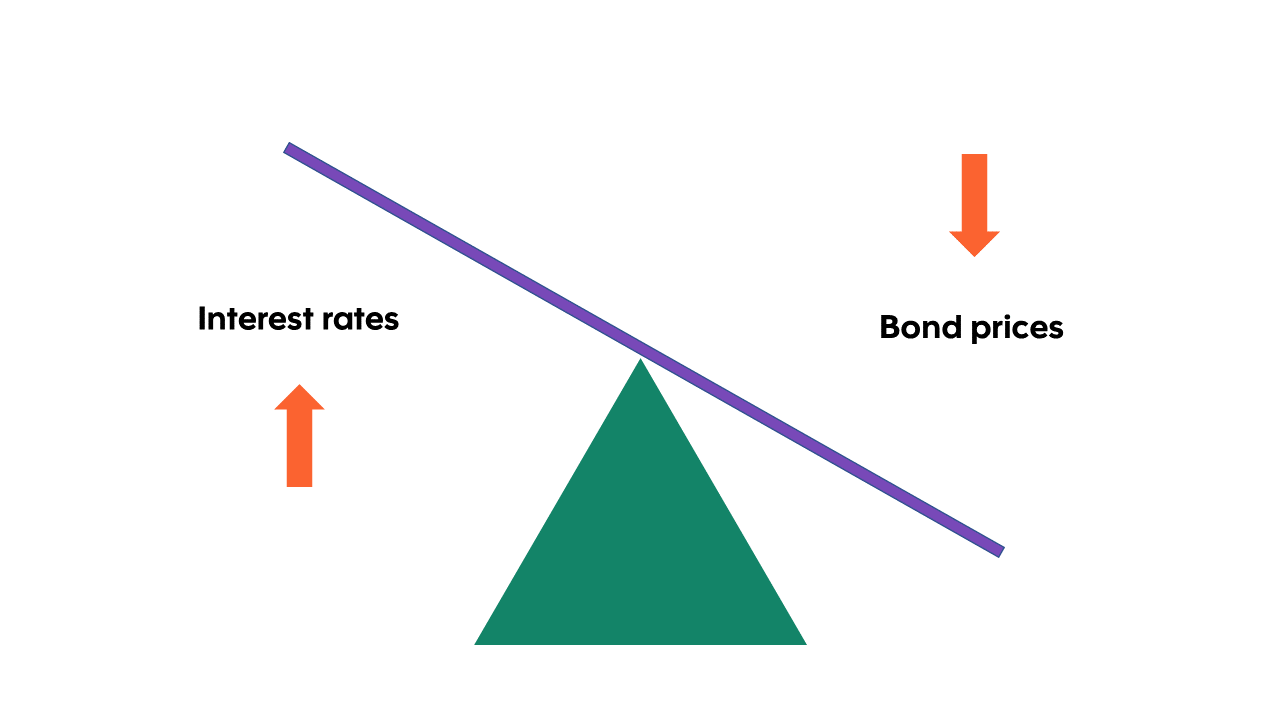

Like a teeter-totter, interest rates and bond prices move in opposite directions. When rates fall, bond prices rise, and vice versa (see Figure 2).

Why? A bond’s regular payment is fixed at the time of issue so existing bonds become more attractive relative to newer ones offering lower payments when interest rates fall. This increases their demand and drives up prices for the higher coupon bonds.

The bottom line: By staying invested (while receiving regular coupon payments), bondholders may see their bonds increase in value as rates decline, contributing to a higher total return.

Figure 2: The inverse relationship between interest rates and bond prices

The “income” part of fixed income remains attractive

Why? In the last few years, interest rates rose from near zero to levels not seen in over 15 years. And while it’s true that rates are coming off their peak, they are expected to remain elevated relative to recent history.

Bond yields have risen to the occasion over the last few years:

- 2.5%: the average Canadian bond yield over the last 10 years

- After a steady rise in interest rates over the last few years, yields reached 5% in 2023 and remain elevated

- The last time bond yields were this high was 15 years ago

- Bonds are offering historically high yield despite interest rates softening

The bottom line: While interest rate cuts reduce yields for new bond investors, yields remain elevated compared to those several years ago. That means today’s coupon payments have put the “income” back in fixed income, providing a high level of regular income for bond investors.

Bonds are back

Try not to let recency bias cloud your investment strategy. Despite recent struggles, bonds are well positioned to make a comeback. They continue to provide a reliable source of regular income and also serve as effective portfolio stabilizers and diversifiers. In times of equity market uncertainty, bonds can mitigate portfolio losses by offering a cushion against the volatility of equities.

All well diversified portfolios should have an allocation to fixed income. After a long period of near zero income, bond investors are now getting paid a higher coupon. In addition to once again providing steady income, actively managed bond funds should also provide a reduction in overall portfolio return volatility by acting as a ballast relative to risk assets such as equities.

Seizing the bond opportunity

To recap, total bond returns are a function of two main components: regular coupon payments and any price change. And so, the combination of coupon payments reaching their highest levels in over 15 years and the upside potential of bond price appreciation as rates come down creates a compelling investment opportunity. But how can investors seize the opportunity in bonds?

Scotia Portfolio Solutions make investing easy by taking the guesswork out of how – and when – to invest. Scotia’s experienced Multi-Asset Management team positions Scotia Portfolio Solutions to weather any fixed income environment. And as markets navigate shifting monetary policy, the value of actively managed portfolio solutions becomes clear. Throughout any economic cycle or shift, Scotia Portfolio Solutions are adjusted to capitalize on the investment opportunities while mitigating risks through both the underlying fund strategies as well as active portfolio construction.

The outlook for fixed income is positive, with expectations for continued rate cuts and stable economic conditions. However, this doesn’t mean there isn’t risk of volatility. Our active management approach gives us the flexibility to adjust portfolios - from duration adjustments to yield curve positioning and credit allocation changes. We have these ‘levers’ available to help preserve capital during uncertainty but also capitalize on opportune times.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed or insured by the Canada Deposit Insurance Corporation or any other government deposit insurer, their values change frequently and past performance may not be repeated.

This document has been prepared by Scotia Global Asset Management and is provided for information purposes only.

The information provided is not intended to be investment advice. Investors should consult their own professional advisor for specific investment and/or tax advice tailored to their needs when planning to implement an investment strategy to ensure that individual circumstances are considered properly and action is taken based on the latest available information.

Nothing in this document is or should be relied upon as a promise or representation as to the future. Indices are not managed and it is not possible to invest directly in an index.

ScotiaFunds® and Dynamic Funds® are managed by Scotia Global Asset Management, a limited partnership the general partner of which is wholly owned by The Bank of Nova Scotia. ScotiaFunds and Dynamic Funds are available through Scotia Securities Inc. and from other dealers and advisors. Scotia Securities Inc. is wholly owned by The Bank of Nova Scotia and is a member of the Canadian Investment Regulatory Organization.

Scotiabank® includes The Bank of Nova Scotia and its subsidiaries and affiliates, including Scotia Global Asset Management and Scotia Securities Inc. Scotia Global Asset Management® is a business name used by 1832 Asset Management L.P., a limited partnership, the general partner of which is wholly owned by Scotiabank. ® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2024 The Bank of Nova Scotia. All rights reserved.