Key takeaways:

After years of hard work, your retirement will be well-deserved — and in Canada, saving through a Registered Retirement Savings Plan (RRSP) helps you build a bridge to your retirement dreams. Not only does an RRSP reduce your current tax burden, but it also helps ensure your retirement years are financially secure and fulfilling.

But how do these benefits play out when you want to withdraw from your RRSP? Understanding when and how to make a withdrawal can be crucial for preserving the benefits of saving for retirement through an RRSP.

Thinking about withdrawing from your RRSP? You can, potentially, make an RRSP withdrawal at any time — but you may face certain tax implications.1 Let's unpack what the RRSP redemption rules mean for you.

An RRSP is more than just a savings account: It's a smart tool for Canadians to reach their retirement goals, complete with some great tax advantages. But, as with anything tax-related, there are a few RRSP withdrawal rules you'll need to keep in mind. Here's what you need to know.

Inside your RRSP, your money does the heavy lifting for your retirement planning — whether it's interest, dividends or capital gains, it's all growing tax-sheltered within your RRSP. The catch? When you withdraw these funds, the amount you withdraw becomes part of your taxable income for the year. This shift from tax-sheltered growth to taxable income is a key consideration for your financial planning.

Wanting to withdraw from a locked-in RRSP? Typically originating from pension plans, locked-in RRSPs have their own rulebook when it comes to withdrawals: Withdrawing from a locked-in account isn't as flexible as withdrawing from an RRSP that's not locked-in.1 Not sure if your RRSP is locked-in? A quick call to your RRSP provider should give you all the details you need.

If you're planning to transfer funds between RRSPs or other registered funds, the transfer isn't considered a withdrawal.2 This is an important distinction because it means a transfer has different tax implications. Keeping this in mind helps you avoid any surprises come tax season.

Withdrawing from your RRSP isn't just about accessing funds. You'll be reporting the amount you withdraw as income on your tax return — an important step for staying on top of your tax obligations. Accurate reporting of your RRSP withdrawals is key to keeping your tax life smooth and compliant.

Here's where everything gets a bit more technical. When you withdraw money from your RRSP, your financial institution will withhold a certain amount for taxes. This rate varies based on how much you withdraw and where you live. Think of this withholding as a pre-payment of the tax you'll owe on that income. Being aware of these withholding rates can help you be more strategic about your RRSP withdrawals.

Consider this: The “when" of your RRSP withdrawal affects your withholding tax and, ultimately, how much income tax you end up paying. This means deciding when to withdraw funds from your RRSP isn't just about when you need the money. It's about making your withdrawals in a tax-smart way.

Timing is everything, and choosing the right time can influence your overall income tax situation when paying taxes for the year. Whether you're planning a regular withdrawal or eyeing an early one, it's important to seek advice from a tax specialist to fully understand the tax implications.

To illustrate, consider the tax impact of making an RRSP withdrawal in the following three different situations:

- During a career break. Suppose this year you decided to take a leave, which results in a significant reduction of your income for the year. Withdrawing from your RRSP during this period could be tax-efficient, since your income is lower so you'll likely be in a lower tax bracket — which means your RRSP withdrawal could be taxed at a lower rate.

- In a high-income year. Let's say you've received a substantial bonus at work this year and you want to use this bonus for the down payment on a weekend cottage. It's not enough on its own, though, so you're thinking about making an RRSP withdrawal to help with the down payment. In this case, it may not be a tax effective decision to take money out of your RRSP, as it adds to your already increased income for the year, and could push you into a higher tax bracket.

- Post-retirement. You've retired, and you're no longer receiving regular employment income, which possibly puts you in the lowest tax bracket you've been in for years. Strategically and gradually withdrawing from your RRSP during these retirement years can help keep your total income within the lower tax bracket threshold and maximize your after-tax income.

Withdrawing from your RRSP involves more than just deciding to take out the funds you need. Please note, fees may be applied when withdrawing early. Here's a step-by-step guide to making an RRSP withdrawal:

1. Check if your RRSP is locked-in. Before withdrawing, determine if your RRSP is locked-in, as withdrawals from a locked-in RRSP are generally restricted. Contact your RRSP issuer if you're unsure.

2. Decide on the withdrawal amount. Plan how much you need to withdraw. Remember, the amount withdrawn will be taxed as income.

3. Understand the tax implications. Withdrawing funds from your RRSP will result in withholding tax, which immediately reduces the amount you receive.

4. Request the withdrawal. Contact the financial institution holding your RRSP to request the withdrawal. They will process the withdrawal and hold back the applicable amount of withholding tax.

5. Report the withdrawal on your taxes. All RRSP withdrawals must be reported as income on your tax return. Your financial institution will provide you with a T4RSP or T4A slip, to be attached to your return.

If you are looking to purchase your first primary home, or looking to pay the tuition for your education, there are two great ways that you can leverage RRSP to withdraw funds tax-free and repay later.

- Home Buyer's Plan (HBP). The HBP opens doors for eligible first-time homebuyers, allowing them to withdraw up to $60,000 from the RRSP tax-free and repay later.

- Lifelong Learning Plan (LLP). If education lies on your horizon, the LLP allows you to withdraw up to $10,000 tax-free from your RRSP and repay later.

- RRIF (Registered Retirement Income Fund). As retirement nears, converting your RRSP into an RRIF could be a wise decision, offering you a different approach to managing your retirement funds.

Each of these options comes with its own unique set of rules and tax implications,3, 4, 5 and depending on your specific circumstances, may be worth considering as an alternative to an RRSP withdrawal.

Deciding to tap into your RRSP early is a decision that shouldn't be taken lightly.

RRSP withdrawals at age 55

Withdrawing from your RRSP at 55 can result in immediate tax costs. For example, if you withdraw $10,000, you'd be looking at a withholding tax of up to 20%, meaning $2,000 could be withheld. Plus, the withdrawal increases your taxable income for the year, which could bump you into a higher tax bracket. And the money you withdraw reduces your RRSP contribution room, which limits your future retirement savings potential.

Convert to an RRIF

The bottom line? No matter what age you are, if you withdraw from your RRSP, you'll need to deal with the tax implications — which can be significant, depending on your financial circumstances for example your income level and your tax bracket at the time of withdrawal.

So what should you do if you're getting close to retirement (for example, you're 60 or 65) and you'd like to begin getting continuous income from your RRSP before you retire? In this scenario, a smart strategy is to convert either the full amount or a partial amount of your RRSP to an RRIF.

By converting to an RRIF, you can obtain a consistent income stream. There is no tax withheld when the minimum amount is withdrawn from the RRIF. Any withdrawals over the minimum amount would attract withholding tax similar to withdrawals from an RRSP.

The rest of your retirement funds continue to accrue benefits on a tax-deferred basis. You can even continue contributing to an RRSP, as long as you aren't 72 or older and you still have unused RRSP contribution room.

Let's look more closely at the impact of withdrawals on your RRSP contribution room. Contribution room is the maximum amount you're allowed to contribute to your RRSP for the year:6 Think of it as a bucket that fills up each year based on your income and unused past contribution room.

When you withdraw from your RRSP, this amount, which is also subject to withholding tax, isn't added back to your contribution room. Here's an example: Let's say your contribution room for this year is $40,000 and you withdraw $10,000 from your RRSP. Your contribution room doesn't revert to $40,000 the next year to make up for the amount you withdrew this year. Instead, it remains at $30,000, plus any new contribution room you've accrued based on that year's income.

The result? A reduced contribution room which limits your future RRSP contributions and potential tax-deferred growth. Combine this with the possibility that your RRSP withdrawal could push you into a higher tax bracket (and tax rate), and it's clear that the long-term effects of making a withdrawal should be carefully considered in your financial planning.

Navigating the tax implications of RRSP withdrawals7 can feel like a complex journey. Simply put, while the money in your RRSP grows tax- free, you do need to pay tax on any funds you withdraw. And the tax story doesn't end there. A withholding tax is deducted right at withdrawal, serving as a pre-payment of your yearly income tax. Plus, over-contributing to your RRSP also brings its own tax implications.

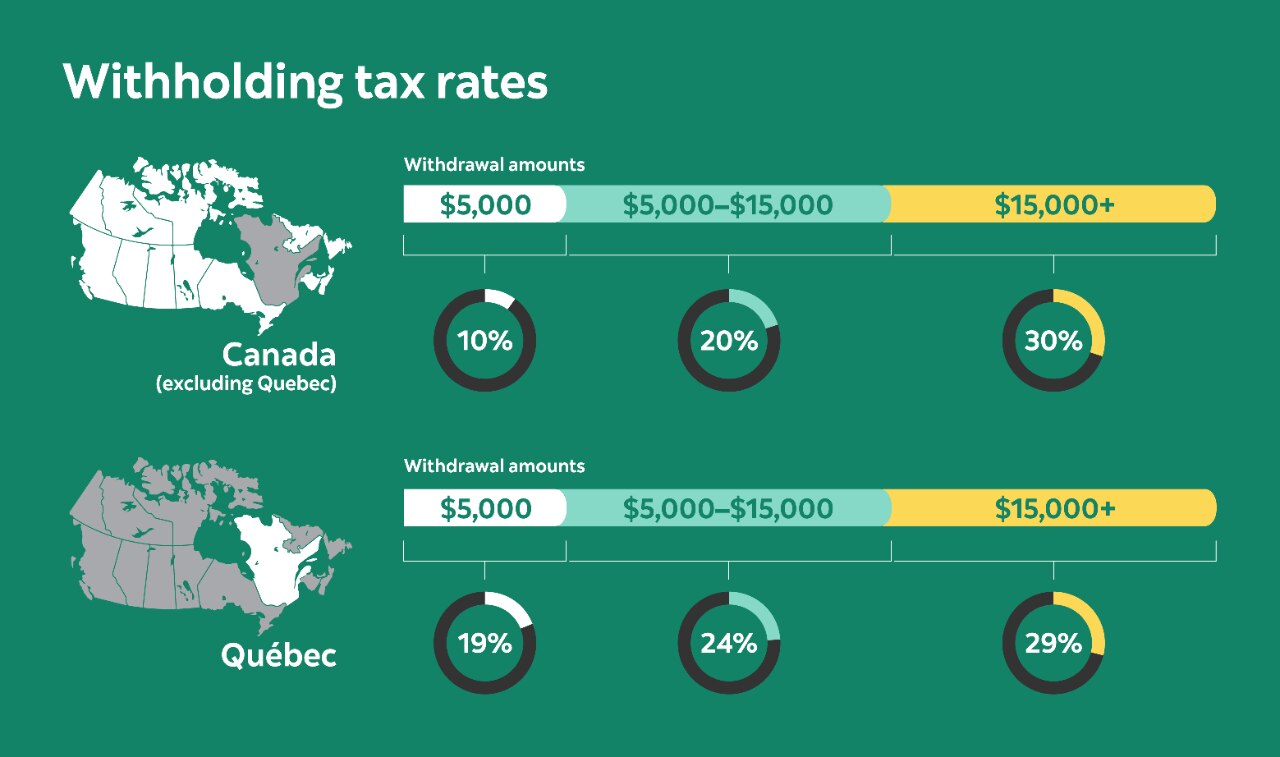

When you make withdrawals from your RRSP, be prepared for the withholding tax that your financial institution will apply. Here are the current withholding tax rates (Quebec residents face slightly different rates plus an additional provincial tax):8

- For withdrawals up to $5,000: 10% (19% in Quebec)

- For withdrawals between $5,000 up to $15,000: 20% (24% in Quebec)

- For withdrawals over $15,000: 30% (29% in Quebec)

This withholding tax is the government's way of ensuring you pay some tax on your withdrawal immediately. This isn't your total tax liability for the withdrawal, though. You may owe more or less in taxes based on your overall taxable income. If your income is low, you may get a refund of some of the withholding tax you've paid.

Your RRSP deduction limit is the maximum you can claim as a deduction on your tax return for your total RRSP, PRPP (Pooled Registered Pension Plan) and SPP (Specified Pension Plan) contributions. If you contribute too much, it's called over-contribution.

Here's the deal: If your RRSP contributions exceed your limit by more than $2,000, you've over-contributed. The Canada Revenue Agency (CRA) applies a 1% monthly penalty tax on these over-contributions.

If you accidentally contribute too much, don't panic: You have options, such as withdrawing the excess contributions (keep in mind that the withdrawal might be taxable) or demonstrating that the contributions are part of a qualifying plan.9

Your best bet for avoiding an over-contribution penalty? Keep a close eye on your contribution limits, which you can easily find in your CRA My Account or on your latest tax assessment.10

Spousal RRSPs are RRSPs you set up for your spouse or common-law partner, and the rules for spousal RRSP withdrawals have their own unique twist, adding an interesting layer to retirement planning.

If the annuitant withdraws funds from the spousal RRSP within 3 years of a contribution, the amount will be included in the income of the contributor in the year of the withdrawal.

Form T2205 helps you sort out what amount goes on which person's tax return.11 It's all about teamwork here, ensuring you both stay on top of your tax game.

Now that we've explored the complexities of RRSP withdrawal rules, let's broaden our perspective by comparing RRSPs with TFSAs (Tax-Free Savings Accounts).

RRSPs are excellent for retirement savings, deferring taxes on your funds until withdrawal, while also providing a tax deduction on your contribution. TFSAs, on the other hand, offer immediate tax-free growth plus the flexibility of withdrawing your funds tax-free. On the downside, there's no tax deduction for your TFSA contributions.

Deciding which is more beneficial depends on your individual financial goals and circumstances. Here's how RRSPs and TFSAs compare:

| RRSP | TFSA | |

|---|---|---|

| Who qualifies for the account | Any Canadian resident or non-resident under the age of 71 | Any Canadian resident or non- resident 18 years or older (or the age of majority in your province) with a valid SIN* |

| Tax-deductible contributions | Yes | No |

| Tax-free withdrawals | No | Yes |

| Maximum contribution limit | Subject to Canada Revenue Agency (CRA) regulations | Subject to CRA regulations |

| Deadline to close account | December 31 of the year you turn 71 is the last day you can contribute to the account | n/a |

*A non-resident can open a TFSA if they have a valid SIN, but they cannot contribute into a TFSA. If they do so, there would be penalties.

Bottom line

Your RRSP is much more than just a savings account: It provides you with the means to enhance your financial well-being. Being informed so you can make the best choices about your RRSP withdrawals will help ensure your retirement is as comfortable as it can be.

Find out how much you’ll need to save for your retirement with our retirement savings calculator. Plus, learn how you can conveniently and automatically build up you your savings with our Pre-Authorized Contributions tool.

Commissions, trailing commissions, management fees and expenses may be associated with mutual fund investments, including ETFs. Please read the prospectus before investing. Mutual funds and ETFs are not guaranteed, their values change frequently and past performance may not be repeated.

Sources: