CANADA IS CURRENTLY ATTRACTING LESS PRIVATE CAPITAL FOR THE CLIMATE TRANSITION THAN THE U.S., BUT CAN IMPROVE

- The low-carbon transition has already begun changing investment patterns globally, with fierce inter-country competition for private capital seeking to invest in green projects.

- Much of the Canadian federal government’s climate commitments over the next decade (nearly $129B) has an explicit aim of leveraging public spending to drive greater private sector investment.

- The little data available on how much private capital has been attracted through this spending thus far shows a private-to-public attraction ratio of just under one. This falls below global estimates (2.2x) and returns seen in the U.S. (5.5x).

- The federal government’s own estimates show total climate spending needs are roughly $125B-$140B annually by 2050. Meeting this goal would require a much larger private response than currently seen today to avoid public spending increasing to unsustainable (or unrealistic) levels.

- A wide range of challenges are preventing Canada from realizing these returns including policy and regulatory uncertainty, difficulties accessing pledged public capital, higher rates of public infrastructure ownership, and a need for more skilled workers.

- The key to attracting more capital is improving Canada’s overall investment environment. To support this, policymakers need to reduce uncertainty, fast-track regulatory approvals, and make it easier for projects to access public funding.

The world has committed to heading in a low-carbon direction. 86% of global energy-related emissions are currently covered by a net-zero target (chart 1). Much of this interest has been driven by efforts to keep temperature increases under nationally agreed-upon levels, but geopolitics, and competition to attract investment and secure access to inputs for low-carbon solutions, have also played significant roles. There is a chance trends could shift or slow (this year and next, countries representing 50.4% of global emissions are voting in national, parliamentary or legislative elections, and outcomes in the U.S. alone could add 4Gt/CO2eq to global emissions by 2030), but changes are unlikely to fully reverse this path.

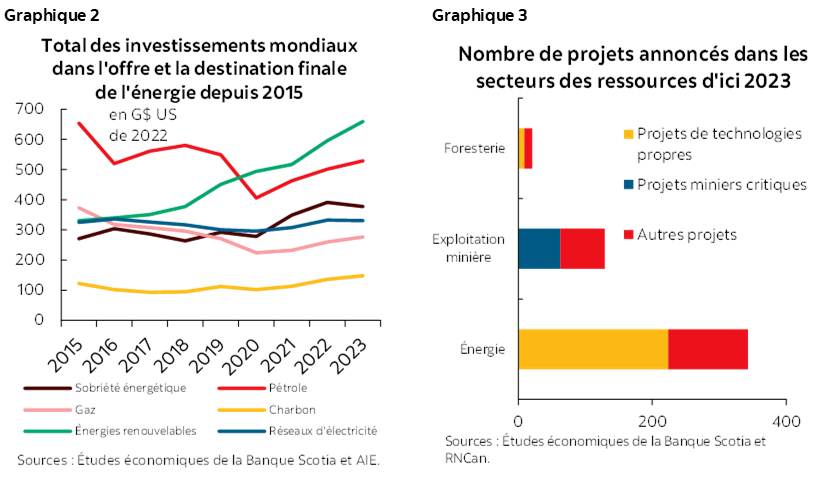

There are signs the low-carbon transition has already brought about fundamental changes in investments for energy systems. While the cumulative sum invested in fossil fuels without CCS still outweighs clean energy solutions, investment in global renewable electricity generation overtook investment in oil production in 2020 and has held since (chart 2). More money globally has been invested in energy efficiency than natural gas since 2019. The IEA reports for every $1 invested in fossil fuel production, distribution and use globally, $1.70 is invested into clean energy, a 70% increase from five years ago. In Canada, clean technologies now represent 65% of announced projects in the energy sector over the next decade. Over the same time horizon, critical metals and minerals projects are expected to bring in over $60B in investment, and now make up two thirds of announced future investment (in dollar terms) in the Canadian mining sector (chart 3). Mining exploration and appraisal expenses for base and other metals (categorizations for critical minerals) have grown by 2.45x–5.47x between 2019–2024 (relative to 1.47x for all other mined commodity categories), an early indication of additional potential investment to come.

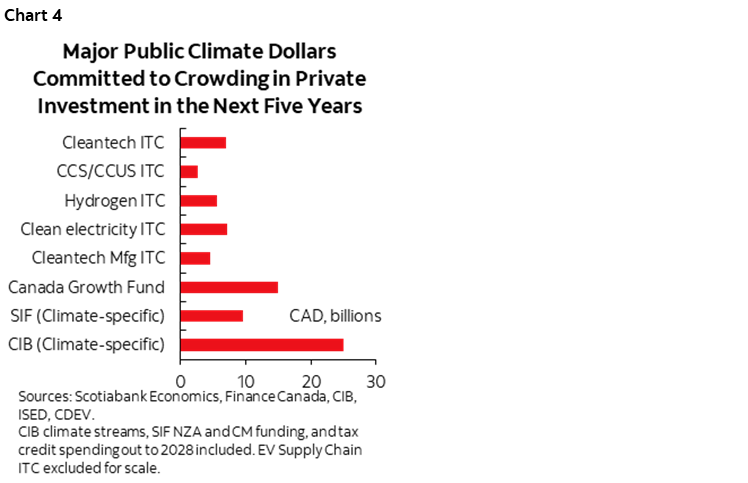

This investment is creating competition amongst governments to attract climate capital, viewed by many as a future driver of economic growth. The primary strategies for attracting capital in the face of escalating competition are industrial policies. Major global efforts include the U.S. Inflation Reduction Act, the EU’s European Green Deal and various Chinese policies, including the 1+N policy framework and several Five Year Plans. These industrial policy suites typically consist of financial incentives and/or trade barriers to support specific sectors (i.e. automotive) and opportunities (i.e. chipmaking). Canada’s federal government has committed the equivalent of 4.6% of 2022 GDP to climate and energy transition investments since Budget 2021 (funding will be distributed out to 2034/2035). Between the Canadian Infrastructure Bank, Strategic Innovation Fund, the Canada Growth Fund, and investment tax credits (ITCs) created in Budgets 2022–2024, almost $129B has been committed to climate projects through programs that have an explicit aim of catalyzing private sector investment (chart 4).

How can we tell if Canada’s high spending is yielding a competitive return in this global contest? Returns for these programs need to be judged both on their success at achieving their primary objective (attracting private capital towards climate goals) and in their longer term impacts on growth. This requires taking into account investment announcements, spending on construction in sectors accessing public funding (to build announced projects), business investment in these same sectors (into machinery and equipment, intellectual property, etc.), and, once projects are operational, production volumes. Given that it is too early for public spending to lead to groundbreaking on major projects in most cases, investment announcements can offer early signs of uptake (longer term economic impacts may not be evident for years, and will only be beneficial if initial investment attraction proves substantial). Without endeavoring to set desired attraction ratios (appropriate risk-adjusted and social returns will vary by program and outcome targeted), one early way to track national performance is to evaluate Canadian progress against benchmarks from international groups and peer countries.

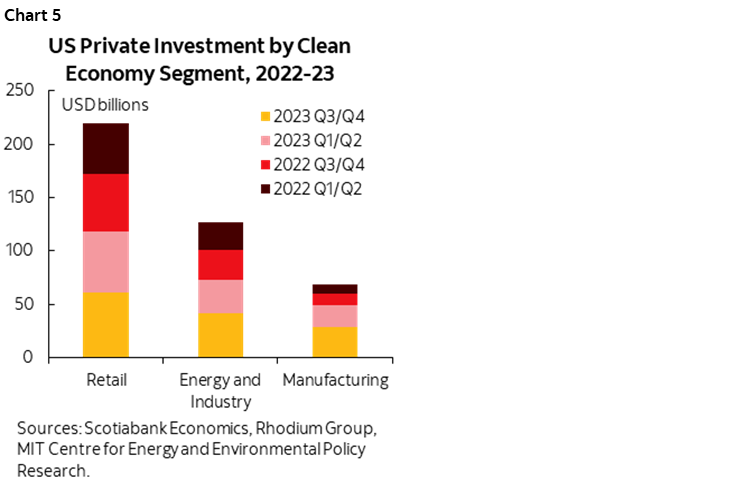

Looking internationally, private sector investment into climate solutions in the U.S. has excelled. Early U.S. data from the Clean Investment Monitor estimates that spending measures in the Inflation Reduction Act have catalyzed 5.47x in private investment ($34B USD in public funding versus $220B USD in total investment) (chart 5). Given the dominance of tax credits in the financing mix, these sums are presumed to reflect net expenditures (this would not be the case if loans were issued instead of tax credits). U.S. rates of capital attraction have exceeded benchmarks set by the IEA globally, who note 37% of clean energy financing from 2016–2020 was from governments, which it expects to decline to approximately 31% by 2030. These two examples equate to ratios of roughly 2.2x (IEA international benchmark) and 5.5x (U.S.-levels) private-to-public-capital invested in clean energy and climate solutions.

From what data is available, Canada’s progress appears slower. Focus here is given to the programs that have a stated objective of attracting private sectoral capital, and that have already begun spending (which does not include the ITCs). Canada’s blend of programming (i.e. loans, grants, tax credits, etc.) and recipient’s frequent “stacking” of supports from distinct federal and provincial programs means no single private-to-public ratio can fully reflect the entire portfolio or suite of projects. The Canada Infrastructure Bank’s (CIB) Q3 2023–2024 reporting identified public investment of $11.6B had been into projects that have managed to attract $11.1B in private and institutional capital, a 0.96x ratio for catalyzing attracting private sector investment (Based on data from a June 2023 Legislative review, the climate-specific portion of CIB’s investments have a 0.99x ratio). CIB has seen performance of 0.9x–1.2x since 2021, and has a target of 1x private and institutional capital to CIB capital across its portfolio by 2025–2026. The fiscal costs to the federal government were 14.5% and 18% of loan value for projects reaching financial close in 2021–2022 and 2022–2023 (which would amount to roughly $460M and $830M in the two years respectively). The Canada Growth Fund only made its initial investments in late 2023, but differences between mandates and governing approaches between CGF and other programs may lead to stronger results (and more ambitious targets).

Other programs report seeing stronger results, but it is difficult to determine exactly how much success can be attributed to any one program. Since 2021, the Strategic Innovation Fund (SIF) has publicly announced approximately $6.1B in funding for climate projects across Canada. As of March 31st of this year, 60% of total climate spending has been allocated into “spending attraction and retention” (Roughly $3.6B has been invested into ZEV and battery supply chain projects). SIF has self-reported an 8.8x private-to-public capital ratio, exceeding the original 3x target set by the program. It is unclear how much credit can be attributed to SIF individually for capital attraction. According to official announcements, SIF was the sole public funder for only 43% of climate projects receiving grants and for only one third of projects valued over $100M, with other funding provided by a mix of federal and provincial programs and bodies. The use of “primarily repayable grants” indicates announced federal contributions should not be fully interpreted as permanent net outflows (how much remains unclear, as data on repayable and non-repayable sums for individual grants was not available). Provincial spending is often not detailed by program or priority within budgets, and was excluded from this analysis due to lack of comparability.

If Canada could leverage private sector capital at levels similar the U.S. (or estimated by international groups), it could improve on recent history. Rhodium Group estimates that actual clean energy investments made up 5% of total share of U.S. net private investment in Q4 2023. Were this figure equivalent in Canada, it would be equal to $9.9B over that same three-month period. In Budget 2022, the federal government estimated $15B–$25B was invested in climate solutions over that entire year (combined public and private capital), meaning approaching U.S. sums would nearly double levels of investment reported two years ago. Even if a direct comparison between current U.S. and CAN investment is imperfect (instruments under the IRA have already begun allocating capital and Canada’s proposed ITCs have not, amongst other differences), the reality remains that upcoming federal ITCs and currently existing instruments have potential to plug early gaps. If changes were made to improve national performance, returns could potentially be closer to benchmarks estimated by international groups or seen in the U.S.

An improvement could also help plug the financing gap currently seen to reach net-zero goals. The federal government has identified that reaching net-zero goals will require between $125B–$140B in investment annually by 2050. In the absence of attracting additional private capital through upcoming and existing measures, Canada will either have to dedicate more public dollars towards financing the transition (potentially to fiscally unsustainable, or even unrealistic, levels), or risk not having sufficient sums to finance national objectives.

Meeting financing goals should take lessons from the U.S., a jurisdiction currently seeing strong private climate investment. There were 210 major clean energy projects announced in the U.S. in the first year of the IRA alone, relative to only 72 announced climate projects between the SIF, CGF and CIB since 2021 as of March 31, 2024 (public dollars allocated per project vary). Some of this difference is attributable to structural factors, such as the relative scale of U.S. markets to Canada (leading to less available capital and smaller average infrastructure project sizes), shorter construction seasons, and a smaller pool of skilled workers (although, as noted, an adjusted investment figure would still be higher than Canada is currently seeing). Other differences likely have to do with public vs. private ownership of targeted sectors, and the differences in “carrot” & “stick” approaches between the two countries. Clean Investment Monitor data estimates the highest investment linked to IRA incentives has been directed into privately-owned household solutions (i.e. zero emissions vehicles, heat pumps, etc.), renewable generation and storage assets, and segments of battery manufacturing supply chains. These solutions are also targeted by Canadian programs, but so are major publicly-owned infrastructure investments (i.e. electricity transmission, public transit, etc.). In the case of publicly-owned assets, CIB has already noted complexity of agreements and partnerships is slowing investment rates. Household and business investment in Canada has likely also been induced by “sticks” (i.e. pricing and regulatory measures), which are not present to the same degree in the U.S. (stick-induced investments also may not leverage spending programs and are therefore harder to account for).

But wait, there’s more. Regulatory approvals (challenges exist for both pace and process), uncertainty about policies impacting Canadian resource sectors, and the ease of accessing government funding (or the applicability of projects for current or future funding) have also been cited as material. These differences, in particular, may be having impacts that do not show up in investment data, as there is no dataset detailing how many projects were not pursued in the first place (although these factors have been cited in project cancellation decisions).

If Canada wants more private capital than it has today, it should give investors what they need: a better investment environment. Given the volume of public dollars already pledged (and the factors outlined above), it is unlikely that this is purely a problem of lacking capital. Instead, emphasis should be placed on creating an investment environment where a larger number of attractive, bankable projects can be advanced and deployed. Creating this environment will require public capital to be more easily accessible, and structural disadvantages will need to be addressed (where possible). Making pledged public capital more easily accessible by reducing the complexity of partnerships agreements with public bodies, making funding available to as wide an array of entities and partners as possible through the ITCs and existing programs, and lowering the bureaucracy firms need to navigate to access supports, would all be beneficial. Expanding the use of sustainable finance tools, building on leadership shown by Ontario, Quebec and the federal government thus far, should also be prioritized. To improve the broader low-carbon investment environment, key steps should also be taken to minimize uncertainty. Regulatory reviews should be streamlined for low-carbon projects, with fast-tracking used where applicable, and greater policy certainty in the face of upcoming elections is needed to reduce uncertainties in the investment climate. If these steps are taken, Canada has a strong shot at earning a higher return on its public investment than it currently does, and profiting in the global competition to crowd in climate capital.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.