- Chile: Unemployment rate rises to 8.7% due to increase in the labour force

- Colombia: The unemployment rate deteriorated for the second consecutive month, given lower employability in rural areas

- Mexico: The GDP flash showed moderate growth, led by services

CHILE: UNEMPLOYMENT RATE RISES TO 8.7% DUE TO INCREASE IN THE LABOUR FORCE

- Labour market shows resilience despite negative seasonality

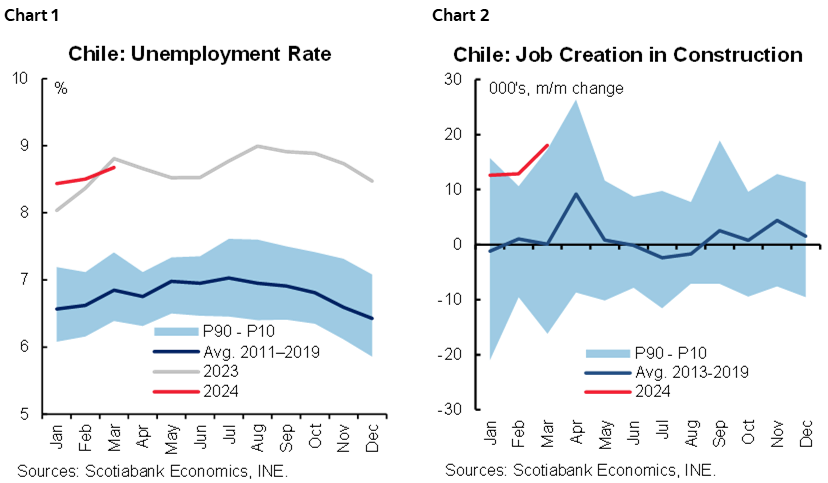

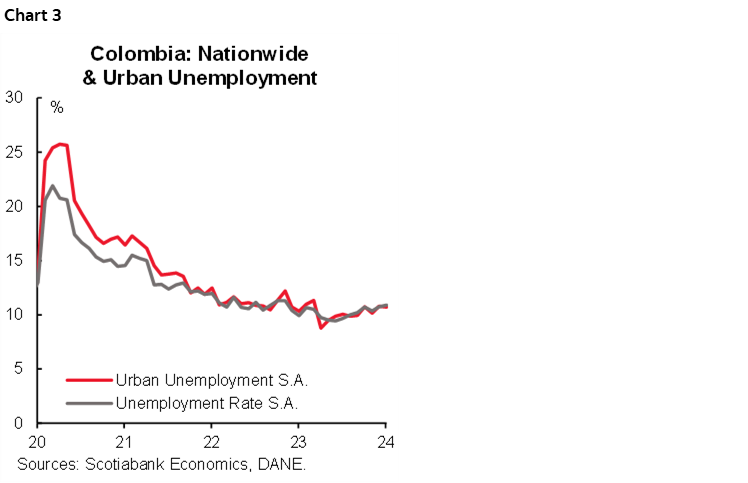

The labour market is showing resilience. We should have seen relevant job destruction given the seasonality, a situation that did not occur. The unemployment rate for the quarter ending in March increased to 8.7% (chart 1), in line with expectations and with the expected seasonality for the month. In a period in which job destruction is historically observed, we are seeing zero job losses, although with heterogeneity between sectors. On the one hand, job creation in sectors such as transport, construction (chart 2) and services stands out, while the drop in employment in industry and commerce is a cause for concern.

Total salaried employment increases thanks to the contribution of the public sector. In a month in which salaried employment normally contracts, 13k jobs were created in the public administration sector, most of them salaried, which provided support to the labour market in a month with an unfavourable seasonality for private employment. In fact, 5k private salaried jobs were destroyed, which, from a historical perspective, is still a favourable performance.

—Aníbal Alarcón

COLOMBIA: THE UNEMPLOYMENT RATE DETERIORATED FOR THE SECOND CONSECUTIVE MONTH, GIVEN LOWER EMPLOYABILITY IN RURAL AREAS

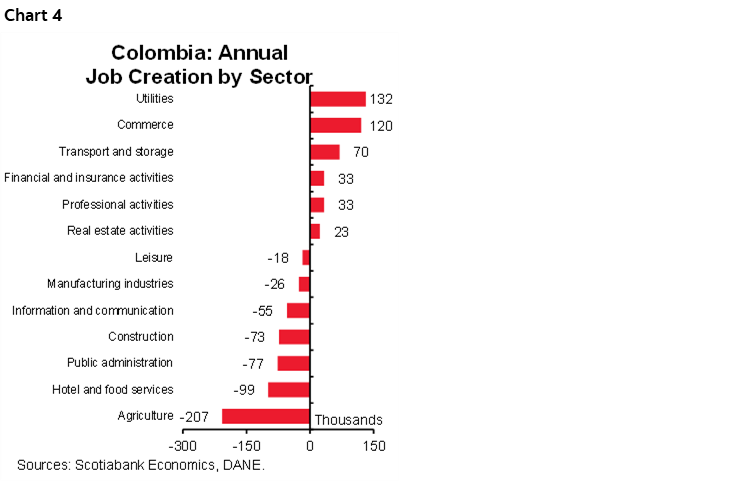

The unemployment rate at the national level stood at 11.3% in March, increasing by 1.3 p.p. compared to the unemployment rate recorded in March 2023 (10.0%), being the second consecutive increase. The urban unemployment rate stood at 10.8%, increasing by 0.3 p.p. on an annual basis. On a seasonally adjusted (S.A) basis, the unemployment rate for the national total stood at 10.9%, increasing from 10.7% in February, while the urban unemployment rate showed a slight improvement from 10.8% in February to 10.7% in March (chart 3).

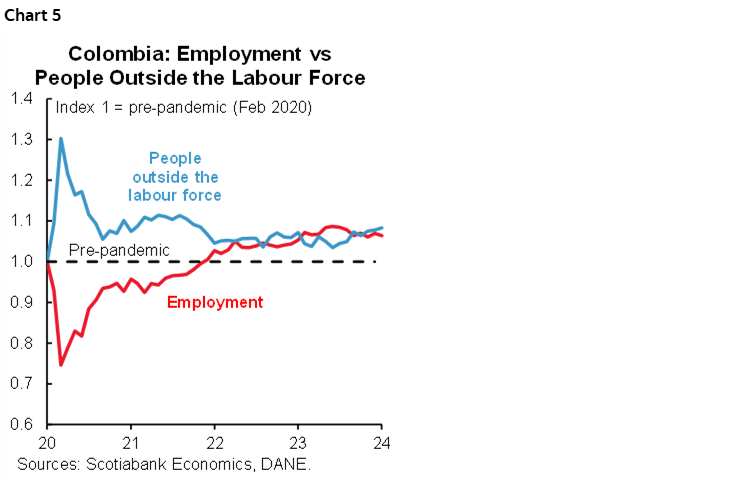

On an annual basis, 149 thousand jobs were destroyed, this being the first negative balance since February 2021. The deterioration of the job creation came largely from the agricultural sector, which reduced 207 thousand jobs, which despite registering a good economic dynamism in the first months of the year, could be experiencing difficulties associated with the El Niño phenomenon. On the other hand, activities associated with the secondary sector continued to show negative dynamics in job creation, especially in the construction sector, with a reduction of 73 thousand jobs. On the positive side, the tertiary sector counterbalanced the general result, with the creation of +132 thousand jobs in the electricity, gas, and water sectors. This is due to a greater demand for workers associated with the crisis the country is going through in terms of energy generation due to the low level of reservoirs.

Among the activities that registered growth in job creation were trade and repair of vehicles, with an increase of +120 thousand jobs. This sector is one of the most important since it concentrates close to 20% of the employed people, which is positive and shows a sign of recovery of the sector, given that up until January 2024, it had remained in negative territory for 10 months and in February it showed a slight rebound of 0.1% YoY according to the Economic Monitoring Indicator (ISE). Even so, it is too early to anticipate a recovery, as the behaviour could also be associated with a seasonal issue (chart 4).

In general terms, the increase in the unemployment rate is mainly explained by the rural component. On a seasonally adjusted basis (S.A), +66 thousand jobs were created in March compared to February, while +77 thousand jobs were created in urban areas, which shows that the deterioration of employment in March would be associated with the destruction of jobs in rural areas outside the main cities of the country.

The dynamics of the labour market would continue to show a lower job creation, as it is evident that the activities that compensated for the drop in March are due to specific factors such as the energy issue, which could persist for a while, but would be erased as weather conditions improve.

Key information on employment data:

- Seven of the thirteen activities under study destroyed jobs in March. A total of 555 thousand jobs were destroyed in March, with the agricultural sector being the main contributor with the decrease of 207 thousand jobs, subtracting -0.9 p.p. to the total variation, followed by the accommodation and food services sector, with the remainder of 99 jobs. Job creation in the remaining six sectors was +411 thousand, insufficient to offset the drop.

- The female population absorbed most of the job creation, while the male population was the most affected. In annual terms, the female population added +29 thousand jobs, with the largest increases in the professional activities sector (+83 thousand), manufacturing industries (+85 thousand), and transport and storage (+56 thousand), while the male population remained at -178 thousand jobs, concentrated in accommodation and food service activities (-129 thousand), agriculture (-112 thousand) and manufacturing industries (-112 thousand). As for the unemployment rate, the male population registered a rate of 8.9% and the female population 14.4%, which represents a gap of 5.5 p.p.

- Informal employment decreased but was not offset by formal job creation. In March, 607 thousand informal jobs were destroyed, and +458 formal jobs were created, leaving 149 thousand people outside the labour market. The proportion of informal employment in the January–March period was 56.3% for the national total, which represents a drop of 1.9 p.p. compared to the same period of 2023 (chart 5).

MEXICO: THE GDP FLASH SHOWED MODERATE GROWTH, LED BY SERVICES

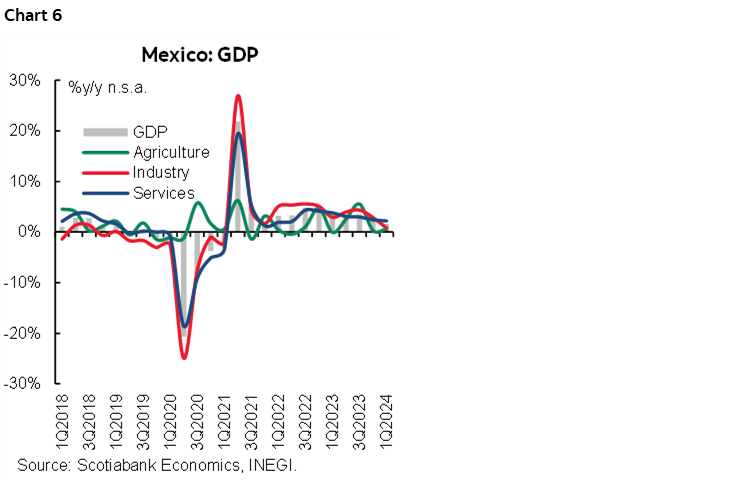

The flash estimate of GDP Q1-2024 showed a slowdown to 1.6% y/y in real terms, from 2.5% previously, below the consensus 2.1%. By sectors, the services sector led the way despite it moderating to 2.2% (2.4% previously), the industry slowed to 0.8% y/y (2.8% previously), while the primary sector moved 0.6% (0.3% previously). In seasonally adjusted data, GDP surprised with a sequential increase of 0.2% q/q, from previous and consensus 0.1%. Services sector rose 0.7% (0.3% previously), but industry decreased -0.4% q/q (-0.1% previously), and the primary sector fell -1.1% (-1.0% previously).

The data indicates that the Mexican economy had a slower pace at the beginning of the year, in contrast to the growth observed during 2023 of 3.2%. Despite the slower than expected numbers, we believe that the impact of the increase in public spending will be more noticeable in the next quarter, accelerating the pace of sectors benefiting from social transfers and electoral spending. We expect services to continue leading growth, as they have maintained significant progress in recent quarters, supported by both retail and wholesale trade, mass media information, professional services, and corporate and business management. On the other hand, the industry is perceived as weak, mainly owing to manufacturing, which has lower levels, as manufactures in US also decelerate, so the sector may not show a significant rebound in the following months, despite the nearshoring medium and long positive expectations. Construction has shown a strong performance and we expect it to remain above double-digit increases, supported by the public projects of the current administration, and by private non-residential investment opportunities regarding nearshoring. Finally, primary activities have had mixed prints in recent quarters, and may be affected by climatic phenomena during the year, mainly due to water shortage problems.

GDP consensus 2024, currently at 2.3% could move down after another monthly indicator showing slower economic activity. However, we still believe greater public spending will boost services in the first half of the year, and that higher than expected economic activity in the US would also benefit specific exports-oriented sectors, such as the auto industry. Thus, we believe there is a strong case for a higher than historical average for 2024 economic activity.

—Brian Pérez & Miguel Saldaña

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.