| ON DECK FOR THURSDAY, MAY 2 |

KEY POINTS:

- Bonds continue to richen post Fed decision, BoC comments

- The Fed was dovish relative to market pricing

- BoC's Macklem doesn't sound like he's cutting in June, maybe not July either

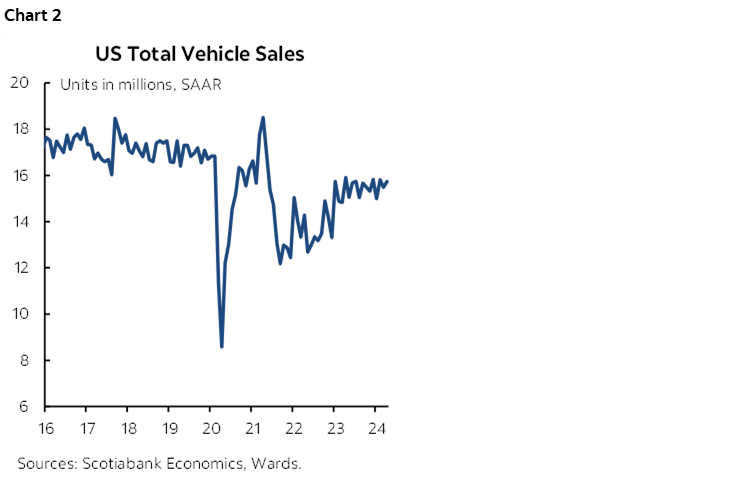

- US productivity slowed, labour costs accelerated

- US layoffs fell to their lowest this year

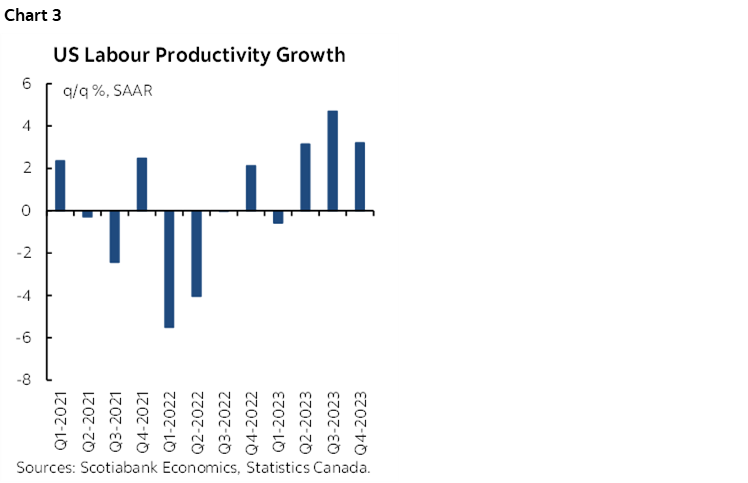

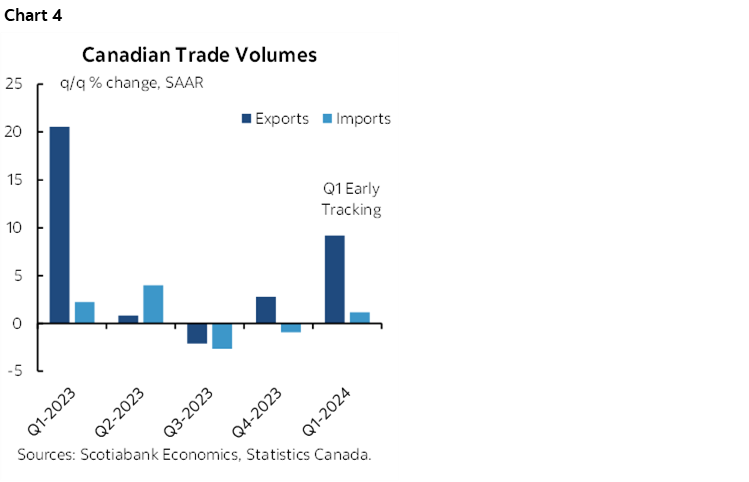

- Canadian trade to inform Q1 GDP growth

- Swiss inflation surprises higher

A quiet overnight session continued to mull over the consequences to what the Fed did and Governor Macklem said. The Fed was relatively dovish and Macklem was relatively hawkish as explained in my note to subscribers (here). Bonds are slightly richer and CAD is a touch stronger to the USD. Pricing for cumulative rate cuts by December is holding at between one and two quarter point cuts which is about 6–7bps more than before the announcements began at 2pmET yesterday. There was very little by way of new information overnight but the focus returns to the US this morning and tomorrow's nonfarm payrolls.

Governor Macklem and SDG Rogers take another swing at it today when they do round #2 of parliamentary testimony at 8:45amET. The opening statement will be the same as the one issued yesterday (here). I think the press coverage entirely missed the salient points and some of the press didn’t even cover it one bit. Therefore I’ll repeat the passages that caught my eye:

“I realize that what most Canadians want to know is when we will lower our policy interest rate. What do we need to see to be convinced it’s time to cut? The short answer is we are getting closer. We are seeing what we need to see, but we need to see it for longer to be confident that progress toward price stability will be sustained.”

“In the months ahead, we will be closely watching the evolution of core inflation. We remain focused on the balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour as indicators of where inflation is headed.”

“To conclude, we’ve come a long way in the fight against inflation, and recent progress is encouraging. We want to see this progress sustained.”

Macklem might have said this during his earlier goofy love-in with Chair Powell that was effusive with praise toward one another. Yet the key parts included the emphasis upon ‘months’ (ie: plural) and “sustained.” Combined, they indicate that Governing Council wants to see quite a bit more inflation data before pulling the trigger. This guidance goes back to the narrative advanced by the BoC since last Fall that laid out three steps on the path to potential easing: a period of weaker core inflation; establishing confidence that this will be sustained; and then having a dialogue on whether and when to ease. Macklem is saying they’re on that path but haven’t reached the third stage yet. I think that’s the right way to proceed since for all we know the Q1 softening in core inflation readings may have been a flash in the pan for reasons I’ve been arguing. Since we only get one more month of inflation data before the June 5th meeting it would seem to be inconsistent to turn around and cut so soon, barring a large shock. It’s not even clear that July is when they’ll go since the two months of CPI figures we get on May 21st and June 25th would barely meet the “months” test even assuming that they come in softly which is not assured. April CPI, for instance, faces upward pressure at least upon headline inflation from higher gasoline prices and carbon taxes and we’ll need to see if there is pass through alongside any potential rebound effect in underlying price pressures.

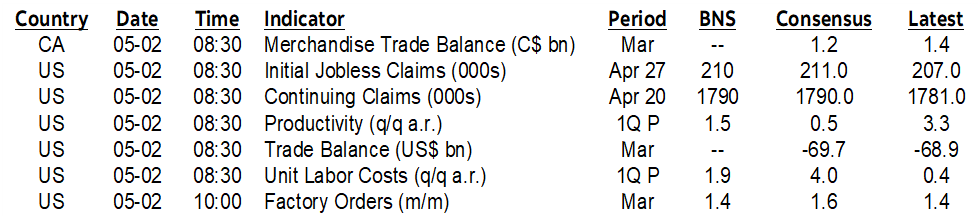

US job cuts fell to 64.8k in April which is the lowest tally since December. January, February and March had been tracking between 82k and 90k layoffs per month (chart 1). This deceleration plays to the narrative that seasonal adjustments might not be doing an adequate job of controlling for workforce trimming at the start of new financial years in the wake of the massive surge in post-pandemic hiring. If so, then further improvement may lie ahead. That said, the layoff figures offer no material consequences to tomorrow's nonfarm payrolls report.

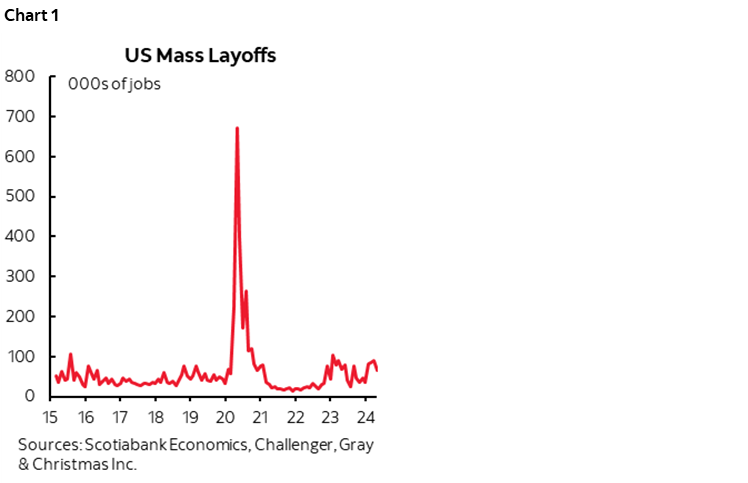

Yesterday afternoon's gain in US vehicle sales offered some upside to the next retail sales print. Vehicle sales were up by +1.6% m/m SA to 15.74 million SAAR and in line with prior industry guidance. That should add about two tenths to retail sales (chart 2).

Swiss inflation surprised to the upside but remains low and in line with the SNB's rough expectations. The franc appreciated a bit on the back of the numbers.

Other US releases will focus upon the job market and its potential contributions to inflationary pressures. Productivity growth is expected to slow compared to the surge over 2023Q2-Q4 shown in chart 3 (8:30amET) and productivity-adjusted labour costs are expected to rise at a quicker pace that could see them rise by +/-4% q/q after being roughly flat in Q4 (8:30amET). This is a huge question mark overhanging the US economy by way of whether the productivity surge and concomitant softening of unit labour costs was temporary or can be sustained.

Canada and the US will also update trade figures for March (8:30amET). Canada may be particularly important as the figures will further inform net trade contributions to Q1 GDP growth during what is so far a great quarter for trade (chart 4).

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.