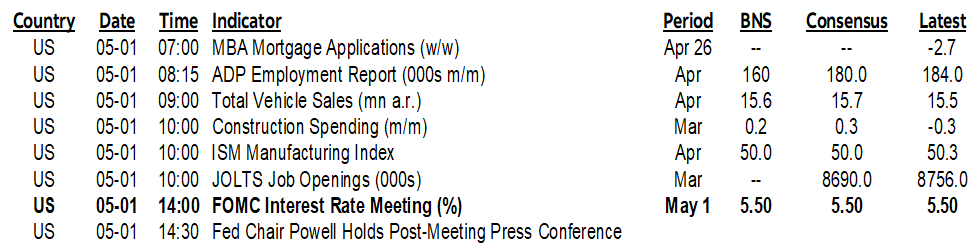

| ON DECK FOR WEDNESDAY, MAY 1 |

- Markets guarded ahead of the Fed with many shut for May Day

- Powell is unlikely to sound more hawkish than what is priced

- US JOLTS, ISM-mfrg, ADP on tap ahead of the Fed

- Kiwi rates shake off NZ jobs and wages

- Canada drives confusion over tax policy

- What’s ‘fair’ about juicing Canada’s Homebuyers’ Plan?

The FOMC will be the prime focus by a country mile but there will be some entertainment along the way. Many global markets are shut for May Day, aka International Workers Day, aka Labour Day outside of Canada and the US. Those markets will catch up to whatever the FOMC does today when they reopen into tomorrow.

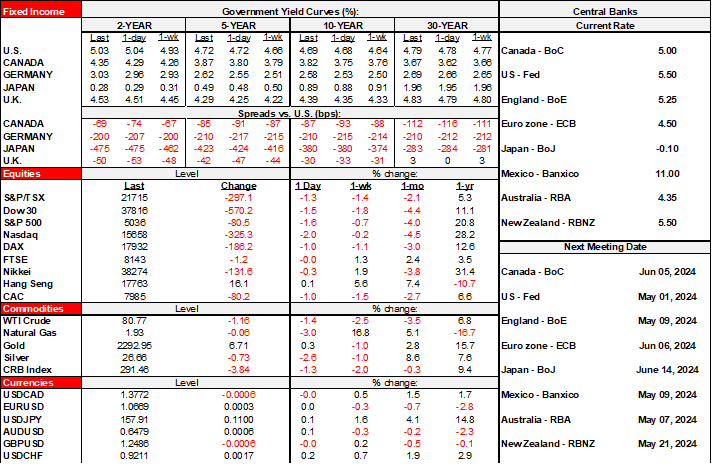

Markets—those that are open—are playing defence ahead of the Fed. N.A. equity futures are lower. US Treasuries are little changed with very slight cheapening at the long-end. The dollar is little changed and the yen continues to shake off intervention from a couple of sessions ago as it trades near 158. The kiwi rates curve barely flinched after jobs fell by -0.2% q/q in Q1 and wage growth landed on the screws at 0.8% q/q. Earnings were mixed in the after-market yesterday as Amazon impressed, but our buzzed out society apparently needs to drink more overpriced coffee.

Several US releases may trigger pre-Fed volatility. ADP shouldn’t because it throws off customary head fakes ahead of nonfarm, but often does (8:15amET). Ditto for JOLTS that is rarely useful as a guide to nonfarm (10amET). And ISM-manufacturing (10amET) is less relevant than its bigger sibling that covers services and that arrives after payrolls on Friday.

IT WOULD BE HARD FOR POWELL TO SOUND MORE HAWKISH THAN IS PRICED

As for the Fed, a fuller preview is in my Global Week Ahead—Too Early to Cut, Too Late to Hike, in reference to the Fed (here). This one is a statement-only affair (2pmET) sans Summary of Economic Projections and hence no refreshed dot plot. Chair Powell’s press conference starts at 2:30pmET and it would be smart to keep this one relatively short, 30-45 minutes, rather than make a contribution to the hall of fame of long and tedious pressers.

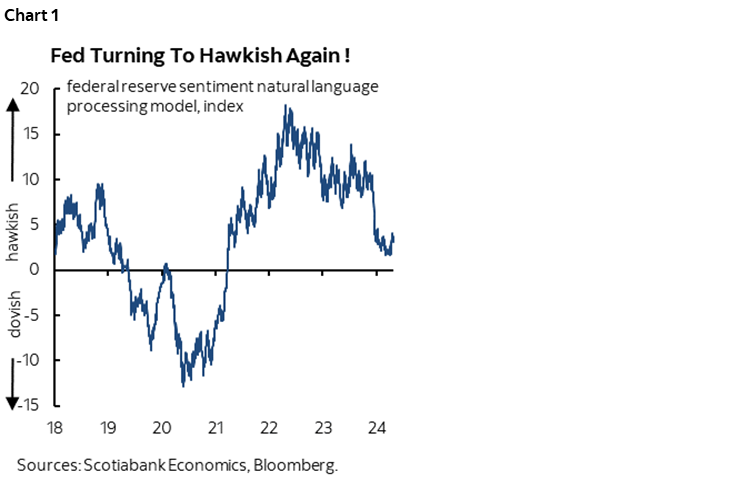

I expect Powell to repeat that they are not meeting the bar for “greater” confidence that inflation risk is sustainably on the path to 2% as a criterion for easing. That would not be new information. He will probably dodge questions about timing cuts and defer to a fuller forecast meeting in June with a freshened dot plot while saying he doesn’t wish to prejudge the outcome. The smartest thing Powell could do today would be to keep it short and sweet and say see ya in June when we’ll update everything. Readings like chart 1 are indicating that the Committee is sounding a tad more hawkish, but nothing like it has in the past.

I also wouldn’t expect him to give up on cuts ‘later’ this year and I would expect him to say that progress on the dual mandate’s goals is likely to be uneven. It’s hard to see him sounding more hawkish relative to what’s already priced and given how far we have come.

I wouldn’t be surprised to hear him refer to evidence that demand and supply conditions are gradually coming back into balance. He could reference arguments for expected slowing growth but may not spell them out quite as fully. What are those arguments? I think dollar strength will gradually crimp net trade. Fiscal is a less powerful contributor to growth at the margin especially in net expenditure terms. Tighter lending conditions still offer lagging effects and we’ll get another Survey of Senior Loan Officer Opinions from the Fed next week that will inform whether credit tightening continues at the margin. He could also point to a general tightening of financial conditions, bearing in mind we’d have a 90bps move higher in US 10s and 70–80bps in 2s this year that is catching up to last Fall’s bond market sell off, plus a 30-year fixed mortgage rate running around 7½% or recently softer equities.

He may also repeat prior references to supply side developments, like trend productivity gains even though we’ll likely suffer a setback in tomorrow’s figures, and mild progress on population growth. Arguments for slower growth and supply side improvements could reinforce one another in terms of the output gap that is presently in excess demand.

I would be very surprised if he talks more hawkishly than what is priced in fed funds futures into year end. He may be quite comfortable with <50bps of easing priced by year-end and -100bps over the next two years, for now. I can’t think he’ll seek to do anything to reduce that and may lend caution in the other direction. Unless everyone is massively misjudging the neutral policy rate by percentage points then it’s probably we’ll get material easing into 2025.

And I’ll fall off my chair if he even remotely hints at rate hikes. He is likely to be asked about them, in which case he’d be unwise to do anything short of batting it down at this juncture. We’ve already had de facto hikes with the massive scaling back of market pricing for cuts. He has other tools he could employ before hikes, like eventually talking down any easing this year to take out the last 25–50bps of easing, referencing higher near-term or long-term neutral rate estimates etc. There is a very high bar set against the resumption of tightening and if met it wouldn’t just mean one hike anyway. They’re a long way from having that sense.

CANADA CREATES CONFUSION AROUND CAPITAL GAINS TAX PLANS

Ottawa likes creating confusion in markets with knee jerk, not terribly well thought-out actions. Market participants have seen that many times. One second, they’re messing with plans around auctions for bonds and bills. Another second, they’re toying with abolishing the CMBs program only to say ‘just kidding’ folks. The latest is confusion among clients toward what is going on with the capital gains tax grab to fund heavy social program spending.

The Budget proposal was missing from yesterday’s Budget motion. We’re told that it will now be advanced in a separate piece of legislation "on its own timeline," whatever that means.

I watched the press conference, replete as it was with the customary amount of finger wagging, condescension, ‘we’re better than all of you’ and divisive tone that always has a campy school cafeteria kind of feeling. Here’s my interpretation of what they’re doing.

When Freeland was asked if she was considering dropping the capital gains tax hike in her presser all she said was:

"We are very committed to the capital gains measures that we put forward in the Budget." This was spun by others as noncommittal. So was this when she was asked again: "I look forward to tabling implementing legislation." She repeated that the Budget's implementation date for this measure is June 25th. When asked when will you be tabling the separate legislation she said:

"The major elements of the capital gains tax move were clearly laid out in the budget annex. I look forward to tabling the implementing legislation. Further details and implementing legislation will be forthcoming and that's all I have to say about it for today."

When directly asked if this was just a political ploy to corner the opposition Conservatives into revealing their stance on the matter, she said ‘No’ with a well rehearsed exhale and a devilish grin that made it apparent she was expecting the question and that this was indeed the reason. Good. I hope the opposition rises to the occasion. It’s bad policy.

But to clients, what the government is doing is unhelpful to say the least. If you’re going to grab more taxes from many ordinary folks, just get on with it. It’s bad enough. But to vacillate creates confusion in the minds of folks who see mixed headlines and anxiously wonder what to do before June 25th. Should cottagers list and sell in a narrow window of time or not? Ditto for securities? Maybe the government doesn’t want too many capital gains being realized now instead of at the higher inclusion rate after June 25th and the way to achieve this is to mess with tax planning of many ordinary Canadians. That’s shameful.

When brought to a vote, it's not a slam dunk that it would pass, but it would require quite a few defections from the left wing Liberal and NDP coalition that makes shooting it down unlikely. Canada's 338 seats in Parliament are broken down as follows at present:

156 Libs

24 NDP

118 Conservatives

32 BQ

2 Greens

3 Independents

3 vacants

To vote it down assuming all Conservatives and all BQ members vote against (they have pledged to vote against the Budget itself) would require another 20 Libs/NDP/Greens/Independents to vote against.

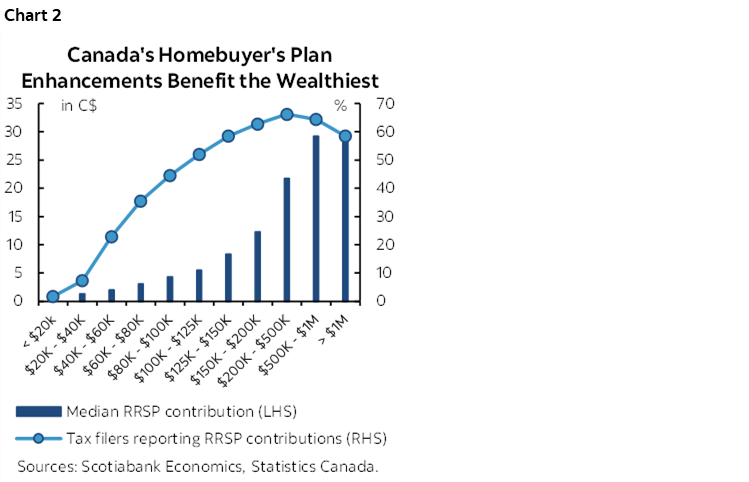

While we’re on the fairness angle….check out chart 2. The table shows median RRSP contributions by income cohort for the latest full tax year of 2022 using data released by StatCan this year. Since you need to make RRSP contributions before participating in the Homebuyers’ Plan, it’s worth looking at who makes the biggest contributions. Not surprisingly it’s the relatively well off and they are the ones most likely to take advantage of the increased HBP limit. I’m pretty sure that those earning hundreds of thousands to millions in annual income don’t quite pass the test of defining the ‘middle class’. They might in the more expensive cities like Toronto and Vancouver, but those income levels are well above how most, such as the OECD, define the middle class.

In all, I remain of the view that this Budget was ‘fair’ in sound bites only. It saddles our youth with more debt to pay out of future income in order to flood the economy with vote grabbing social programs funded by higher taxes that fail to address the root problems facing the economy: productivity, investment, competitiveness and living standards.

DISCLAIMER

This report has been prepared by Scotiabank Economics as a resource for the clients of Scotiabank. Opinions, estimates and projections contained herein are our own as of the date hereof and are subject to change without notice. The information and opinions contained herein have been compiled or arrived at from sources believed reliable but no representation or warranty, express or implied, is made as to their accuracy or completeness. Neither Scotiabank nor any of its officers, directors, partners, employees or affiliates accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents.

These reports are provided to you for informational purposes only. This report is not, and is not constructed as, an offer to sell or solicitation of any offer to buy any financial instrument, nor shall this report be construed as an opinion as to whether you should enter into any swap or trading strategy involving a swap or any other transaction. The information contained in this report is not intended to be, and does not constitute, a recommendation of a swap or trading strategy involving a swap within the meaning of U.S. Commodity Futures Trading Commission Regulation 23.434 and Appendix A thereto. This material is not intended to be individually tailored to your needs or characteristics and should not be viewed as a “call to action” or suggestion that you enter into a swap or trading strategy involving a swap or any other transaction. Scotiabank may engage in transactions in a manner inconsistent with the views discussed this report and may have positions, or be in the process of acquiring or disposing of positions, referred to in this report.

Scotiabank, its affiliates and any of their respective officers, directors and employees may from time to time take positions in currencies, act as managers, co-managers or underwriters of a public offering or act as principals or agents, deal in, own or act as market makers or advisors, brokers or commercial and/or investment bankers in relation to securities or related derivatives. As a result of these actions, Scotiabank may receive remuneration. All Scotiabank products and services are subject to the terms of applicable agreements and local regulations. Officers, directors and employees of Scotiabank and its affiliates may serve as directors of corporations.

Any securities discussed in this report may not be suitable for all investors. Scotiabank recommends that investors independently evaluate any issuer and security discussed in this report, and consult with any advisors they deem necessary prior to making any investment.

This report and all information, opinions and conclusions contained in it are protected by copyright. This information may not be reproduced without the prior express written consent of Scotiabank.

™ Trademark of The Bank of Nova Scotia. Used under license, where applicable.

Scotiabank, together with “Global Banking and Markets”, is a marketing name for the global corporate and investment banking and capital markets businesses of The Bank of Nova Scotia and certain of its affiliates in the countries where they operate, including; Scotiabank Europe plc; Scotiabank (Ireland) Designated Activity Company; Scotiabank Inverlat S.A., Institución de Banca Múltiple, Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Casa de Bolsa, S.A. de C.V., Grupo Financiero Scotiabank Inverlat, Scotia Inverlat Derivados S.A. de C.V. – all members of the Scotiabank group and authorized users of the Scotiabank mark. The Bank of Nova Scotia is incorporated in Canada with limited liability and is authorised and regulated by the Office of the Superintendent of Financial Institutions Canada. The Bank of Nova Scotia is authorized by the UK Prudential Regulation Authority and is subject to regulation by the UK Financial Conduct Authority and limited regulation by the UK Prudential Regulation Authority. Details about the extent of The Bank of Nova Scotia's regulation by the UK Prudential Regulation Authority are available from us on request. Scotiabank Europe plc is authorized by the UK Prudential Regulation Authority and regulated by the UK Financial Conduct Authority and the UK Prudential Regulation Authority.

Scotiabank Inverlat, S.A., Scotia Inverlat Casa de Bolsa, S.A. de C.V, Grupo Financiero Scotiabank Inverlat, and Scotia Inverlat Derivados, S.A. de C.V., are each authorized and regulated by the Mexican financial authorities.

Not all products and services are offered in all jurisdictions. Services described are available in jurisdictions where permitted by law.