8 minute read

Markets can be unpredictable, and 2023 was certainly no exception. The year was marked by a series of surprises and challenges including a banking crisis, wars in Ukraine and the Middle East, and rising costs of living.

But in a year where everything felt bad, most major markets closed off at or near record highs. How and why did that happen? Find out in this article where we recap key market events and unpack the top 5 investing lessons from 2023 to help you make well-informed investment decisions in 2024 and beyond.

Lesson 1: The market is not the economy

Economists’ warnings of an impending recession have long stirred concerns among investors, leading to a sort of ‘recession obsession’ fueled by attention-grabbing headlines. Instead, many investors were left scratching their heads as markets soared while companies faced rising costs for doing business, job cuts mounted, and economic data presented a rollercoaster of negative and positive indicators. Despite the gloomy economic outlook and recession fears throughout the year, most major indices defied expectations and reached new highs in 2023 (Figure 1).

Figure 1: 2023 market performance

| Index | Return |

|---|---|

| Bonds (FTSE Canada Universe Bond) | 6.7% |

| Canadian Equities (S&P/TSX Composite) | 11.8% |

| U.S. Equities (S&P 500, US$) | 26.3% |

| Global Equities (MSCI World, US$) | 24.4% |

| Emerging Markets (MSCI Emerging Markets, US$) | 10.1% |

Source: Bloomberg. Total Return, as at December 31, 2023. Indices are quoted in their local currency. Indices are not managed, and it is not possible to invest directly in an index.

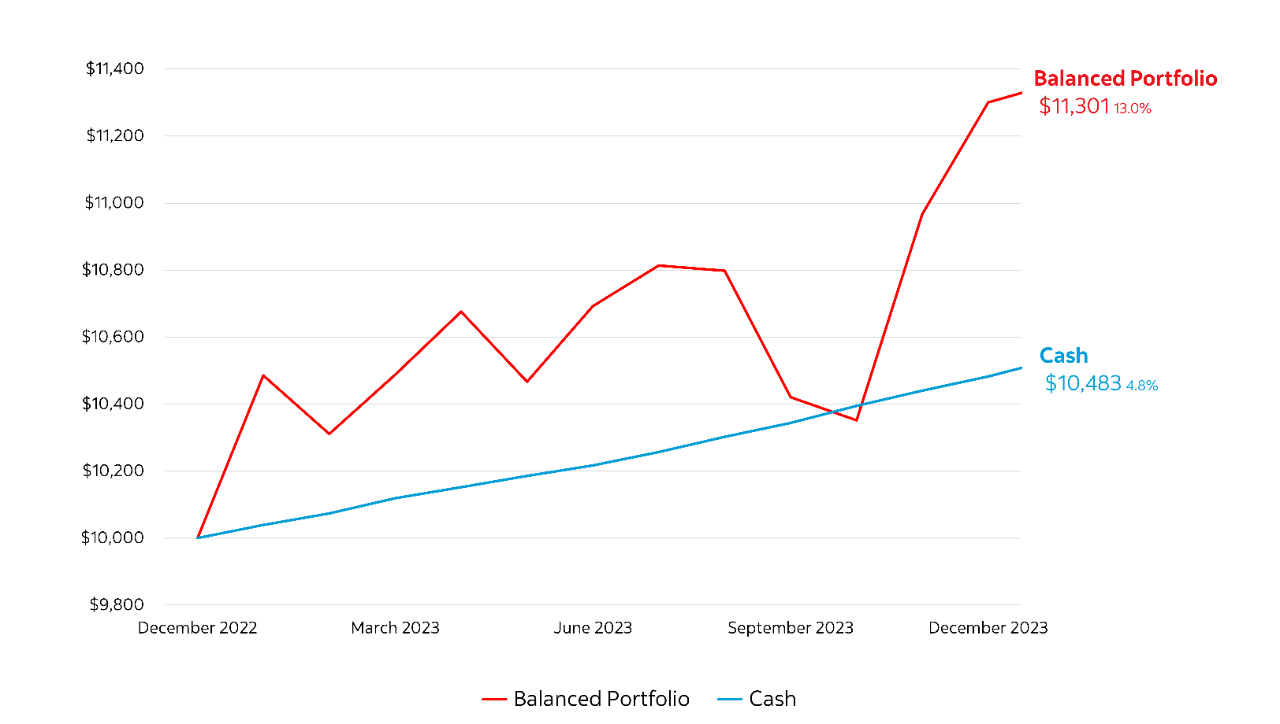

Just like weather forecasts, market and economic predictions can be wrong. While short-term fluctuations are common, markets generally trend upwards over the long-term. And investors who parked their investments in cash at the start of the year due to recession fears would've missed out on significant growth in 2023 (Figure 2).

Figure 2: The cost of waiting on the sidelines

Source: Morningstar Direct, as of December 31, 2023. This chart shows the inferred growth of $10,000 invested from December 31, 2022 to December 31, 2023. For illustrative purposes only. The hypothetical balanced portfolio is composed of 30% S&P/TSX Composite TR Index (Canadian Equities), 30% S&P 500 TR Index (U.S. Equities) and 40% FTSE Canada Universe Bond Index (Canadian Bonds). The cash portfolio is represented by 100% S&P Canada Treasury Bill TR (Canadian T-Bills). Returns are calculated in Canadian currency. Indices are not managed, and it is not possible to invest directly in an index. Assumes reinvestment of all income and no transaction costs, fees, or taxes.

Lesson 2: There are always excuses not to invest

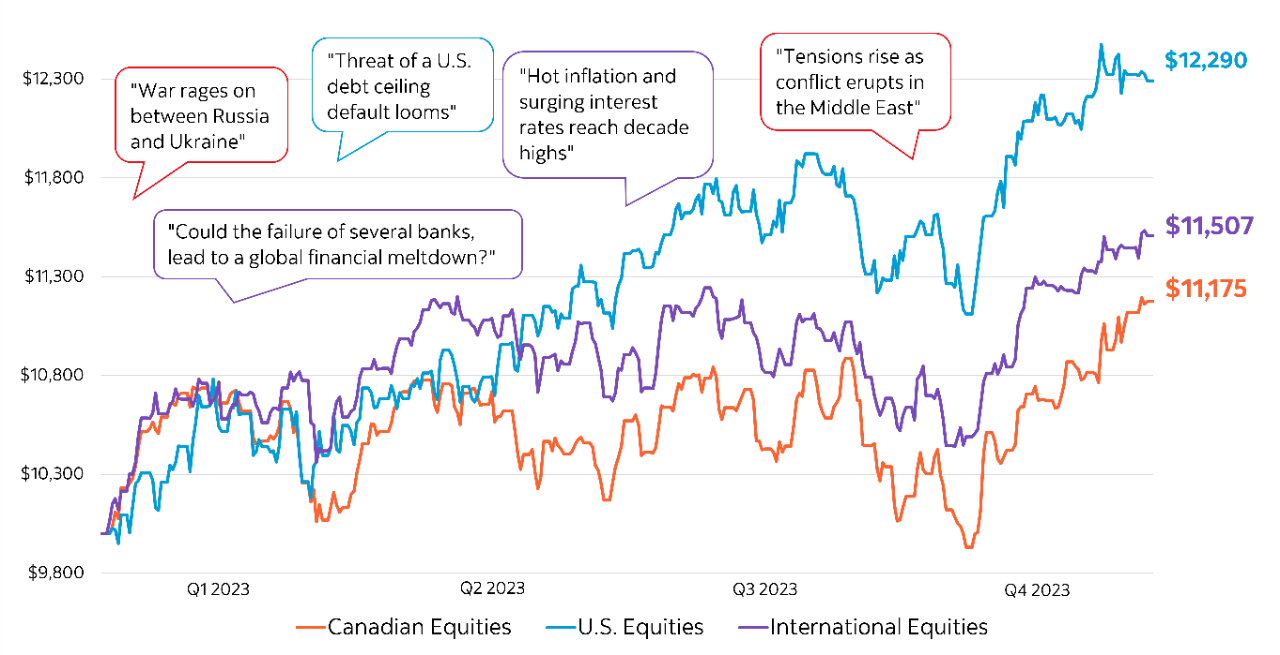

Though markets ended the year with strong performance, it was a bumpy ride along the way. Last year, like every year, presented many “reasons for not investing,” as concerning headlines, especially those about geopolitical conflicts, dominated the news (Figure 3).

Figure 3: Ignoring reasons for not investing in 2023 (Growth of $10,000 over the last year)

Source: Morningstar Direct, as of December 31, 2023. This chart shows the inferred growth of $10,000 invested from December 31, 2022 to December 31, 2023. For illustrative purposes only. Indices are not managed, and it is not possible to invest directly in an index. Assumes reinvestment of all income and no transaction costs, fees, or taxes. Percentage market gain/loss based on return from the S&P/TSX Composite TR Index (Canadian Equities), S&P 500 TR Index (U.S. Equities), and MSCI EAFE NR index (International Equities). Returns are calculated in Canadian currency. Compound growth calculations are used only for the purposes of illustrating the effects of compound growth and are not intended to reflect future values of any mutual fund or returns on investment in any mutual fund.

Scotia Portfolio Solutions have a long history of successfully navigating changing and challenging market dynamics. Scotia Global Asset Management’s Multi-Asset Management team, manager of Scotia Portfolio Solutions, continually seek new ways to enhance diversification, manage volatility and improve the risk-adjusted returns of the portfolios – ensuring investors can remain focused on their long-term goals with confidence.

Lesson 3: Inflation can take a bite out of savings

Canada experienced multi-decade high inflation post-COVID-19, with the consumer price index (CPI) peaking at 8.1% in June 2022. It dropped to 3.1% by late 2023 but stayed above the Bank of Canada’s 2.0% inflation target (Figure 4). In response, central banks aggressively raised interest rates throughout 2023, raising borrowing costs as consumers felt the impact of inflation at the cash register with higher costs for goods and services.

Figure 4: The impact of surging inflation

| Inflation (CPI, year-over-year) | |

|---|---|

| 10-year annual average (2013-2022) | 2.2% |

| 2023 annual average | 4.2% |

| Impact on Canadians | 3 in 4 agree that the rising cost of living has negatively impacted their ability to save/invest. |

Sources: Statistics Canada, Scotiabank Investment Poll, August 2023.

Source: Scotia Global Asset Management Investory Sentiment Survey, November 2023.

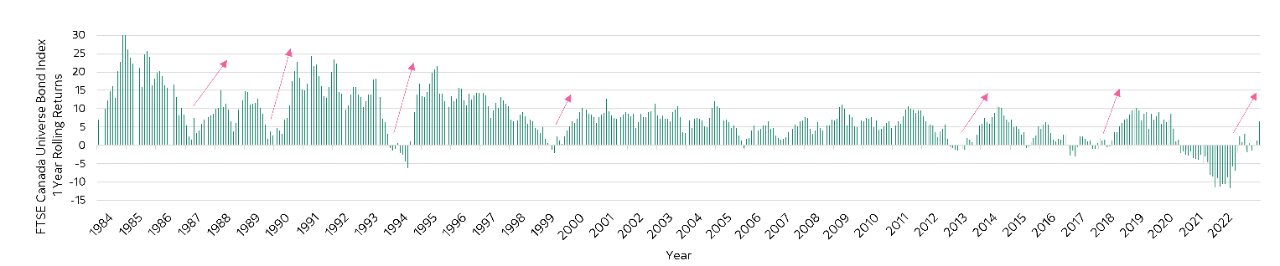

Lesson 4: Don't abandon bonds

After a tough year in 2022, bonds continued to decline in early 2023 as interest rates climbed, tempting many investors to ditch bond allocations from their long-term financial strategy. But the tides turned quickly as cooling inflation positioned central banks to soften their tone about future rate hikes, boosting Canadian bonds to end the year with a 6.7% gain.

Bonds help reduce risk, as they have low correlation with stocks, providing stability and regular income over the long term. And as interest rates fall, bonds stand to benefit, as falling interest rates boost bond prices.

Figure 5: Bonds tend to rebound quickly and strongly after periods of negative returns

Source: Morningstar Direct, data as of December 31, 2023. For illustrative purposes only, it does not constitute investment advice and must not be relied on as such. Indices are not managed, and it is not possible to invest directly in an index. Bonds are represented by the FTSE Canada Universe Bond Index. Returns are calculated in Canadian dollars.

Lesson 5: Winners rotate, diversification is key

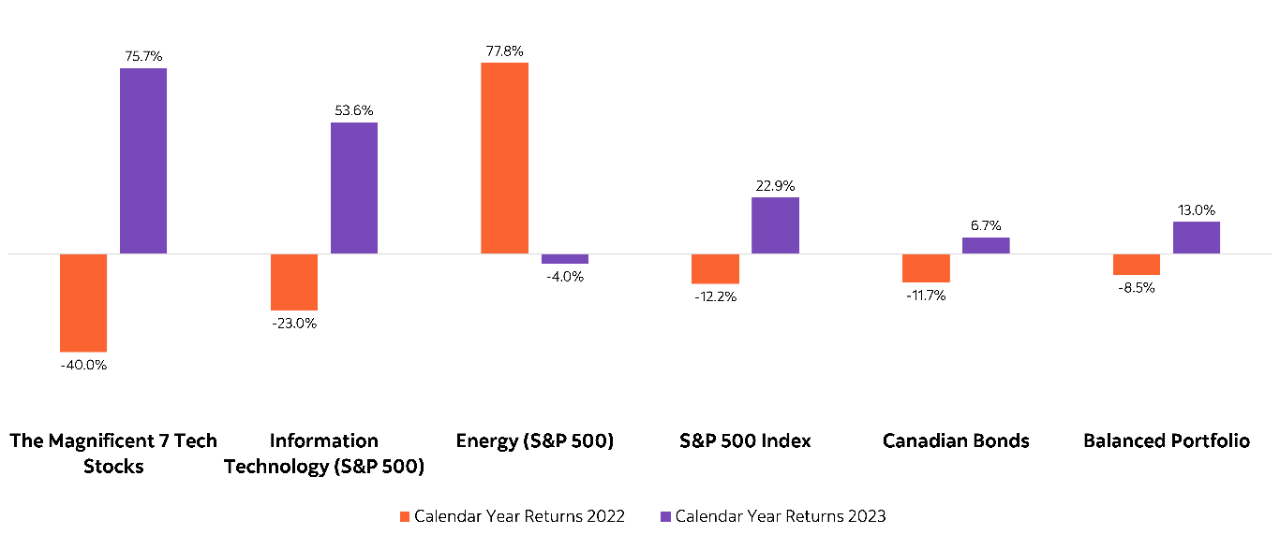

Artificial intelligence (AI) made huge advances in 2023 boosting some technology stocks ('the Magnificent 7') by more than 75%. This stands in sharp contrast to just one year prior when the Information Technology sector dropped 23.0% in 2022. This drastic market shift shows just how unpredictable market leadership can be (Figure 6).

Figure 6: Today’s winners can quickly become tomorrow’s losers

Source: Morningstar and Bloomberg, data as of December 31, 2023. For illustrative purposes only. Indices are not managed, and it is not possible to invest directly in an index. Information Technology and Energy Sectors are represented by sector return in the S&P 500 Composite Index, Canadian Bonds are represented by the FTSE Canada Universe Bond Index, Balanced Portfolio is comprised of 30% S&P/TSX Composite Index TR (Canadian Equities), 30% S&P 500 Index TR (U.S. Equities) and 40% FTSE Canada Universe Bond Index (Canadian Bonds). Returns are calculated in Canadian dollars

There really is no way to know with certainty when specific sectors, styles, or asset classes will outperform and for how long. No single asset class is consistently among the top performers, and the best and worst performers can change from one year to the next. A diversified portfolio of different asset classes provides the opportunity to participate in potential gains of each year’s top asset classes, while aiming to lessen the impact of those at the bottom. Scotia Portfolio Solutions are diversified across asset classes, sectors, and geographies, to name a few, and actively managed to capitalize on investment opportunities across a variety of different market conditions.

The bottom line

The past year has been a testament to the timeless principles of investing. It was a year riddled with unexpected turns, reinforcing the value of strategy over speculation and perseverance over pessimism. As we reflect on 2023, investors can benefit from the following timeless investing principles to help in times of uncertainty:

- Invest early. Embrace the power of compounding. The earlier you start, the longer your investments have to grow, despite what economic predictions or news headlines may say.

- Invest often. Establish and maintain a disciplined approach to investing. Regular contributions are key to building resilience in your financial journey.

- Stay Invested. There are always excuses not to invest. Tuning out the noise, focusing on the long-term, and remaining invested during short term market dips can help keep you on track to reaching your long-term investing goals.

- Diversify. Mitigate risks and capture opportunities with a diversified portfolio. Scotia Portfolio Solutions make investing easy by diversifying across a variety of investments spanning different management styles, asset classes, geographies, industries and company sizes in one convenient solution.

Remember, while you can't predict every market turn, you can prepare for the journey with a financial plan and the help of your Scotiabank advisor.

® Registered trademarks of The Bank of Nova Scotia, used under licence.

© Copyright 2023 1832 Asset Management L.P. All rights reserved. As used in this document, the term “Scotiabank advisor” refers to a Scotia Securities Inc. mutual fund representative or, in Quebec, a Group Savings Plan Dealer Representative. When you purchase mutual funds or other investments or services through 1832 Asset Management L.P. and Scotia Securities Inc.